Starting from January 1, 2025, major cement companies in Vietnam simultaneously raised their selling prices, with an average increase of 50,000 VND per ton, equivalent to a 4.1% rise compared to the end of 2024.

Major companies announce price adjustments

Specifically, brands such as Vicem Bim Son, Vicem Hoang Mai, and Tan Thang announced a price hike of 50,000 VND per ton for both bagged and bulk cement, effective January 1, 2025. Meanwhile, The Vissai Group adjusted prices by 46,300 VND per ton across its affiliated factories, including Vissai Ninh Binh, Vissai Ha Nam, Dong Banh Cement, Song Lam Cement, and Song Lam 2 Cement.

The main reason for the price hike is the continuous increase in production input costs, including coal, electricity, and labor, which have been climbing in recent times and are expected to continue rising in 2025. Notably, on October 11, 2024, the Ministry of Industry and Trade raised the average retail electricity price by 4.8%, significantly affecting electricity-intensive industries like cement production. This is one of the key factors causing cement prices to continue rising in 2025, putting pressure on both manufacturers and consumers.

In addition, the sluggish real estate market and cement oversupply have made it difficult for many factories to sell their products, leading to losses and the risk of production shutdowns. According to a report from the Ministry of Construction, in 2024, the Vietnam Cement Industry Corporation (Vicem) recorded a loss of 1.402 trillion VND.

Construction industry facing mounting pressure

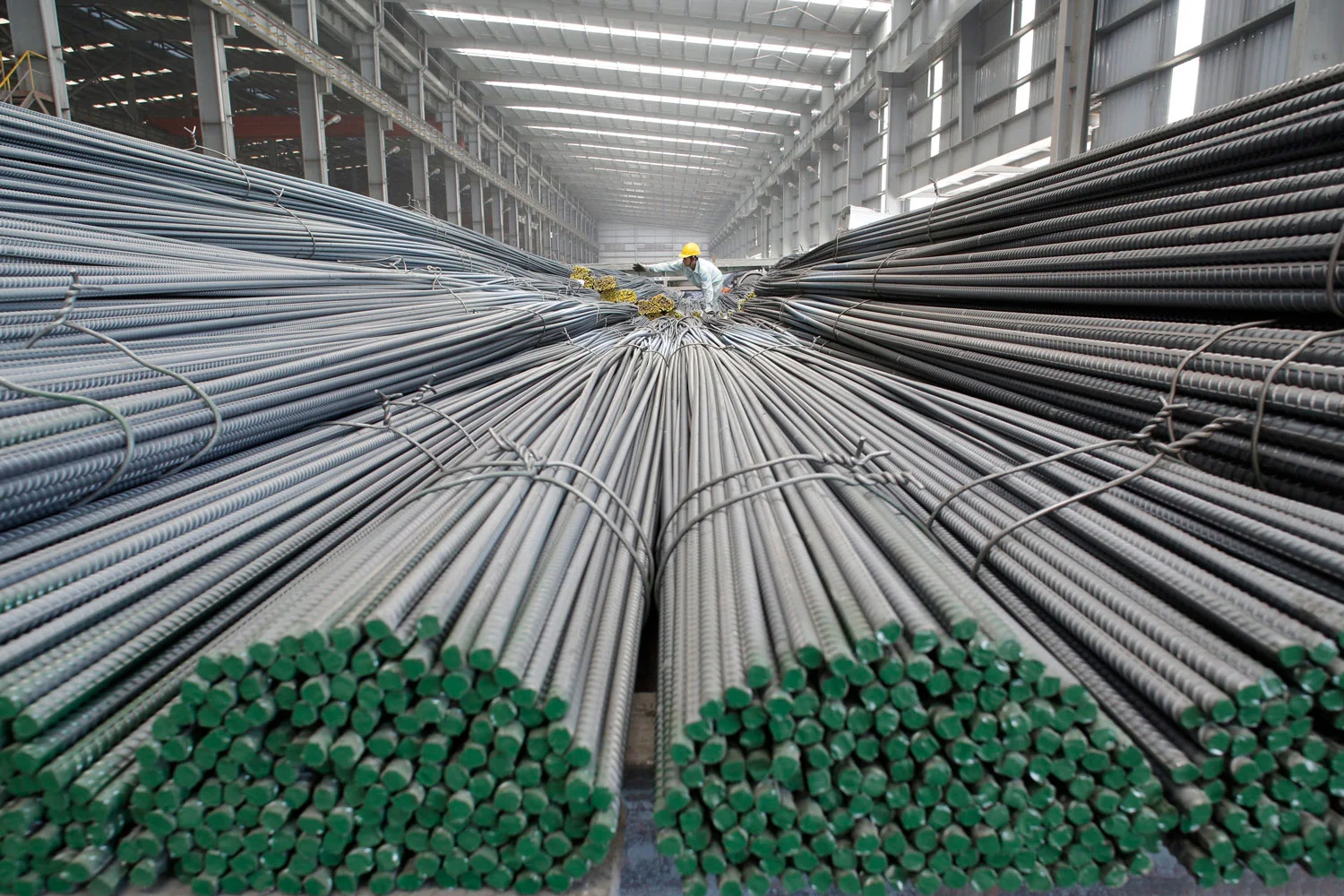

Amid rising electricity prices and a sluggish real estate market, not only the cement industry but also other basic construction material sectors, such as steel and bricks, are facing difficulties and the risk of further price hikes. Construction materials typically account for 65-70% of the estimated project cost, so rising material prices put significant pressure on contractors, especially those who have signed lump-sum turnkey contracts. To minimize the risk of losses, many contractors may choose to delay construction progress, waiting for material prices to stabilize. However, this approach could lead to delays in the project handover schedule. Meanwhile, some contractors may attempt to cut material usage, but this directly impacts construction quality and safety.

Along with cement, other basic construction materials such as steel, bricks, etc. are also expected to see price increases in 2025.

The rising cost of construction materials not only puts pressure on contractors but also on investors. In particular, with the real estate market recovering slowly, higher material prices could create additional financial pressure, forcing many investors to reassess their investment plans for new projects.

Source: Investment Newspaper

See also: Factors Affecting the Cost of Workshop Construction

See also: Glossary related to factory construction costs – Part 1: Distinguishing between BOQ and BOM