According to the latest report from the Foreign Investment Agency (FIA) under the Ministry of Planning and Investment, registered FDI into Vietnam in the first half of 2025 reached USD 21.52 billion, up 32.6% compared to the same period last year and marking the highest level in the past 15 years. This is not only the result of a wave of global supply chain shifts but also clearly reflects Vietnam’s increasingly solid position in the long-term investment strategies of many international corporations.

Positive signals from internal stability

Amid ongoing uncertainties in the global economy, Vietnam’s ability to maintain macroeconomic stability, implement flexible financial policies, and gradually improve its investment environment has been key to reinforcing investor confidence.

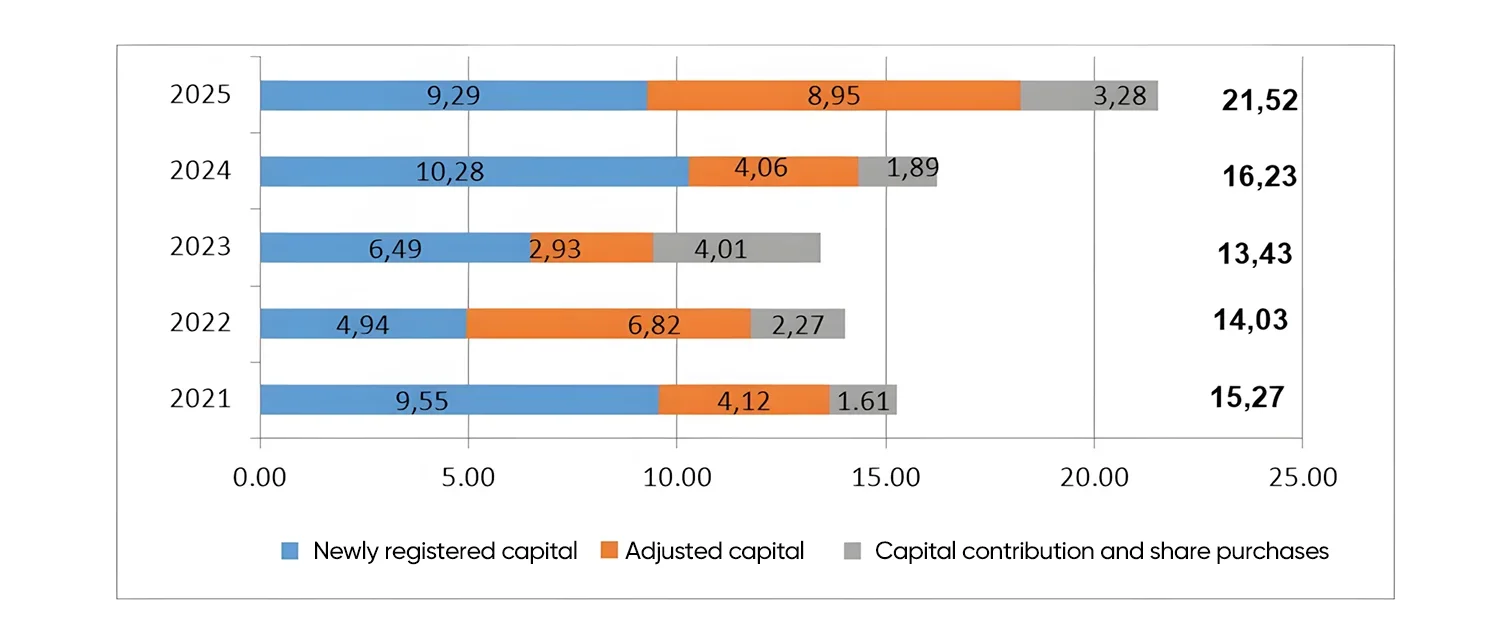

Registered foreign investment into Vietnam in the first half of 2021–2025 (USD billion)

Notably, not only has newly registered capital grown strongly, but additional capital and M&A activities have also surged. Specifically, newly registered capital reached USD 9.29 billion, adjusted capital reached USD 8.95 billion—nearly double the amount from the same period last year—while capital contribution and share purchases totaled over USD 3.28 billion.

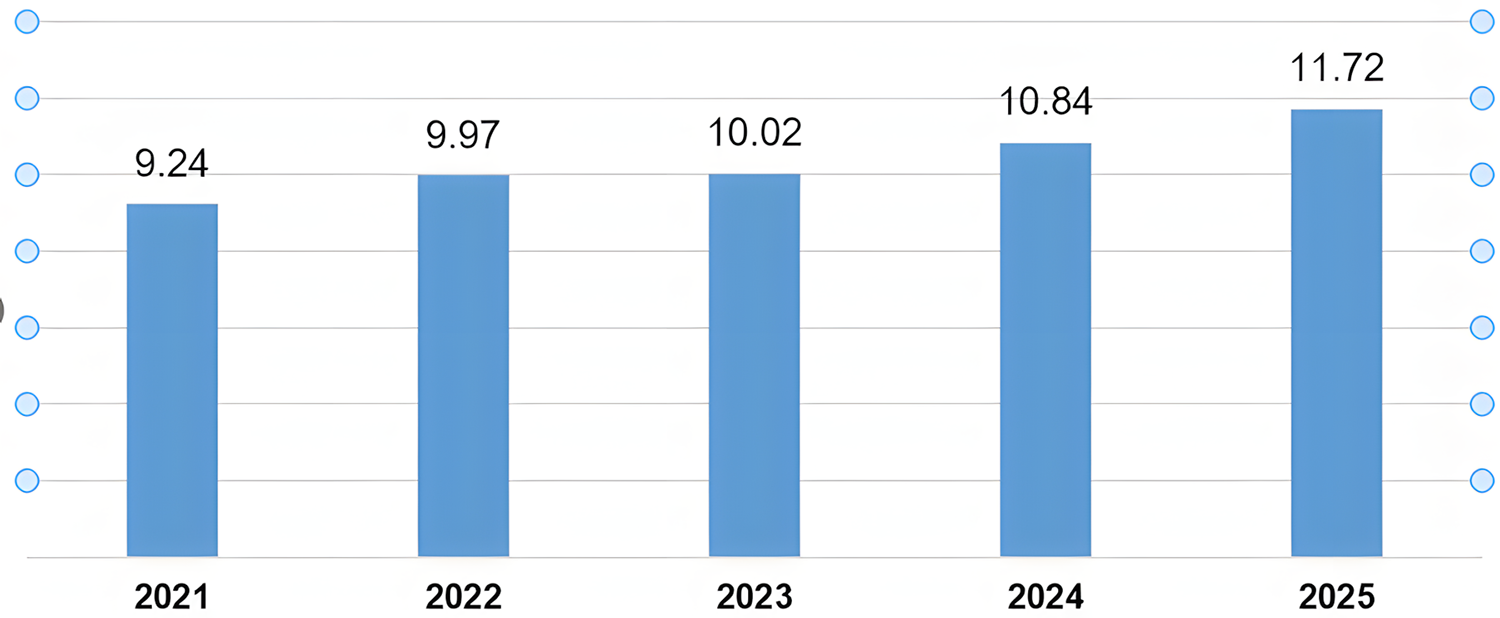

Implemented foreign direct investment in the first half of 2021–2025 (USD billion)

Disbursed capital reached approximately USD 11.7 billion—the highest level since 2020—demonstrating investors’ strong commitment to putting projects into actual operation.

Capital flows target key sectors and emerging growth areas

The shift in foreign investment is not only in scale but also in quality. The manufacturing and processing sector continues to lead, attracting nearly USD 12 billion—accounting for more than half of total FDI. As a capital-intensive and high-execution field, this reflects investors’ strong confidence in Vietnam’s domestic supply chain, skilled labor, and technical infrastructure amid the ongoing global supply chain realignment.

Industrial real estate also recorded significant growth, with around USD 5 billion in registered capital. The rising demand for ready-to-use infrastructure that can be deployed quickly is pushing investors to move from exploratory markets to industrial zones capable of becoming operational within 6 to 12 months.

Geographically, FDI is showing a more diversified pattern, no longer concentrated solely in the three traditional economic centers. While Hanoi, Bac Ninh, and Ho Chi Minh City still lead with over USD 9.5 billion in total capital, provinces such as Gia Lai, Long An, and Quang Ninh are emerging as new destinations—driven by clear industrial development strategies, available clean land, and efficient site clearance processes.

Long-term outlook: Vietnam emerges as a strategic FDI destination in a new growth cycle

Vietnam is steadily positioning itself as a key player in global investment strategies. Recent progress in trade negotiations with the United States not only expands export potential but also strengthens the country’s image as an open, stable, and reliable economy.

Illustrative image

According to a survey by the General Statistics Office, 81% of FDI enterprises expect business conditions in Q3 to remain stable or improve—the highest level in the past three years. In particular, plans to develop international financial centers in Ho Chi Minh City and Da Nang, alongside policies focused on high-quality workforce development and updated legal frameworks for strategic sectors such as AI, semiconductors, and fintech, are laying a solid foundation for next-generation capital flows.

Against this backdrop, opportunity also comes with pressure for industrial infrastructure developers to reposition themselves. Technical readiness alone is no longer enough—they must proactively align with international operating standards, integrate ESG principles, and adopt sustainable development models from the design stage. As capital becomes more selective, the priority is shifting from speed to long-term partnership and sustainability.

Source: Ministry of Planning and Investment, General Statistics Office, Government Portal

See more: Top 5 Ideal Locations for Building Factories in Vietnam after July 1st, 2025

See more: Vietnam develops specialized policies for processing and manufacturing industry

See more: The wave of attracting investment in the electronics industry in Vietnam