From 01/01/2024, the global minimum tax policy is officially applied. FDI enterprises that have an annual turnover of 750 billion USD within 2 years will be subjected to a tax rate of 15%. Will this affect FDI flows in Vietnam, where there are many tax incentives for foreign investors?

Global minimum tax policy

The global minimum tax policy initiated by the Organisation for Economic Co-operation and Development stipulates that FDI enterprises (Foreign Direct Investment) will be imposed at least 15% of the income tax, applicable to multinational companies with annual revenues from 750 million EURO (or 800 billion USD) or higher in 2 of the last 4 consecutive years. If the business is subject to a tax lower than 15% in their investing country, they have to pay the remaining tax to the country where their headquarters are based to meet 15%. It is expected that this policy will be applied from 01/01/2024. Currently, more than 140 countries, including Vietnam, have agreed to a global minimum tax policy. Experts are concerned that this policy will negatively affect the attraction of FDI into Vietnam.

According to the General Department of Taxation, Vietnam has about 335 projects in processing and manufacturing in economic and high-tech zones which are Samsung, Intel, Sharp, and Bosch,… will be subjected to the global minimum tax. The total registered investment capital of these projects accounts for nearly 30% of the total FDI in Vietnam (about 131,3 billion USD). According to experts, Vietnam should propose some measures to deal with this situation to keep a competitive advantage in attracting FDI and avoid affecting the investment plan of other investors.

The global minimum tax rate has impacted the attraction of FDI into the Vietnamese market

Opportunities for Vietnam in gaining other competitive advantages

Contrary to some pessimistic predictions, many experts stated that the investment situation of FDI in Vietnam will not be significantly affected by the global minimum tax policy. This is a chance for Vietnam to develop other factors such as administrative formalities, infrastructure, and human resources to attract investors better.

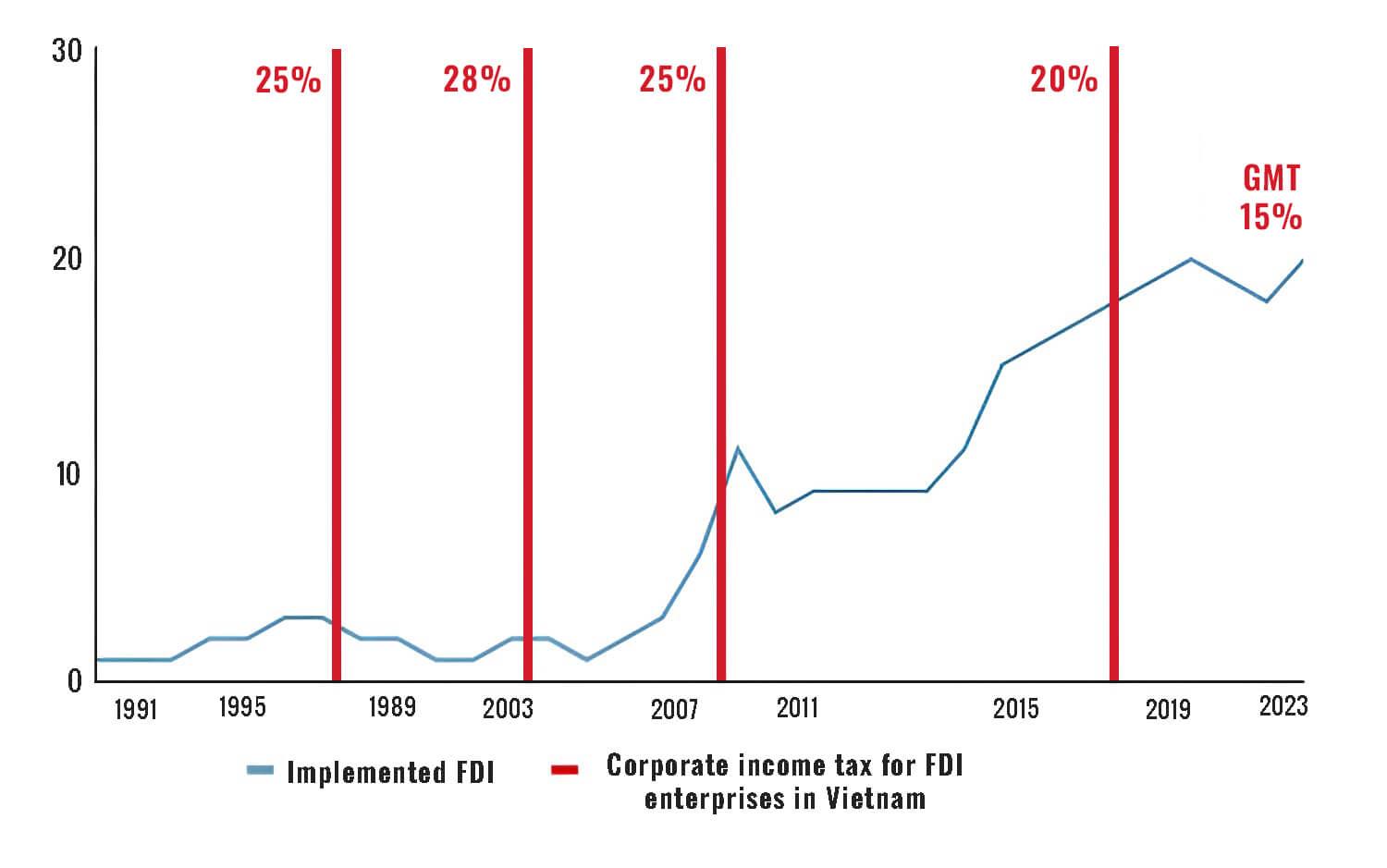

From 1991 to the present, the corporate income tax (CIT) has not significantly impacted the capital inflow of FDI into Vietnam. In 2004, CIT for FDI enterprises increased from 25% to 28%, but FDI capital still grew substantially. Besides, implemented FDI tended to remain flat when cooperating income tax decreased in 2009.

Changes in CIT for FDI businesses in Vietnam by 2023

(Data source: Saigontimes and General Statistics Office)

According to a survey by The World Bank and VinaCapital experts, in addition to taxes, other factors such as political stability, business environment, and infrastructure also play an important role. Vietnam has a stable political environment, a good macroeconomic situation, and an effective restrained inflation. Moreover, Vietnam also has a favorable geographical position for global trade and is close to the supply chain of Asia which is convenient for the production of high-tech products. Viet Nam always has expansionary policies for the regional FDI businesses.

According to JETRO’s surveys and other organizations, Vietnam has a young, cheap, abundant, and professional workforce. In addition, the salary of Vietnam factories is only half of China’s while the productivity of the two countries is similar.

The labor workforce of Vietnam is abundant, the salary is only half of China’s.

Additionally, Vietnam also takes advantage of “friend-shoring”, in which multinational companies prefer to invest in nations where there is minimal chance of being imposed to high tariffs on exports to the US. Vietnam has emerged as a “friend-shoring” destination after the visits of Antony Blinken and significant US delegations and the call from US President Joe Biden and Prime Minister Nguyen Phu Trong.

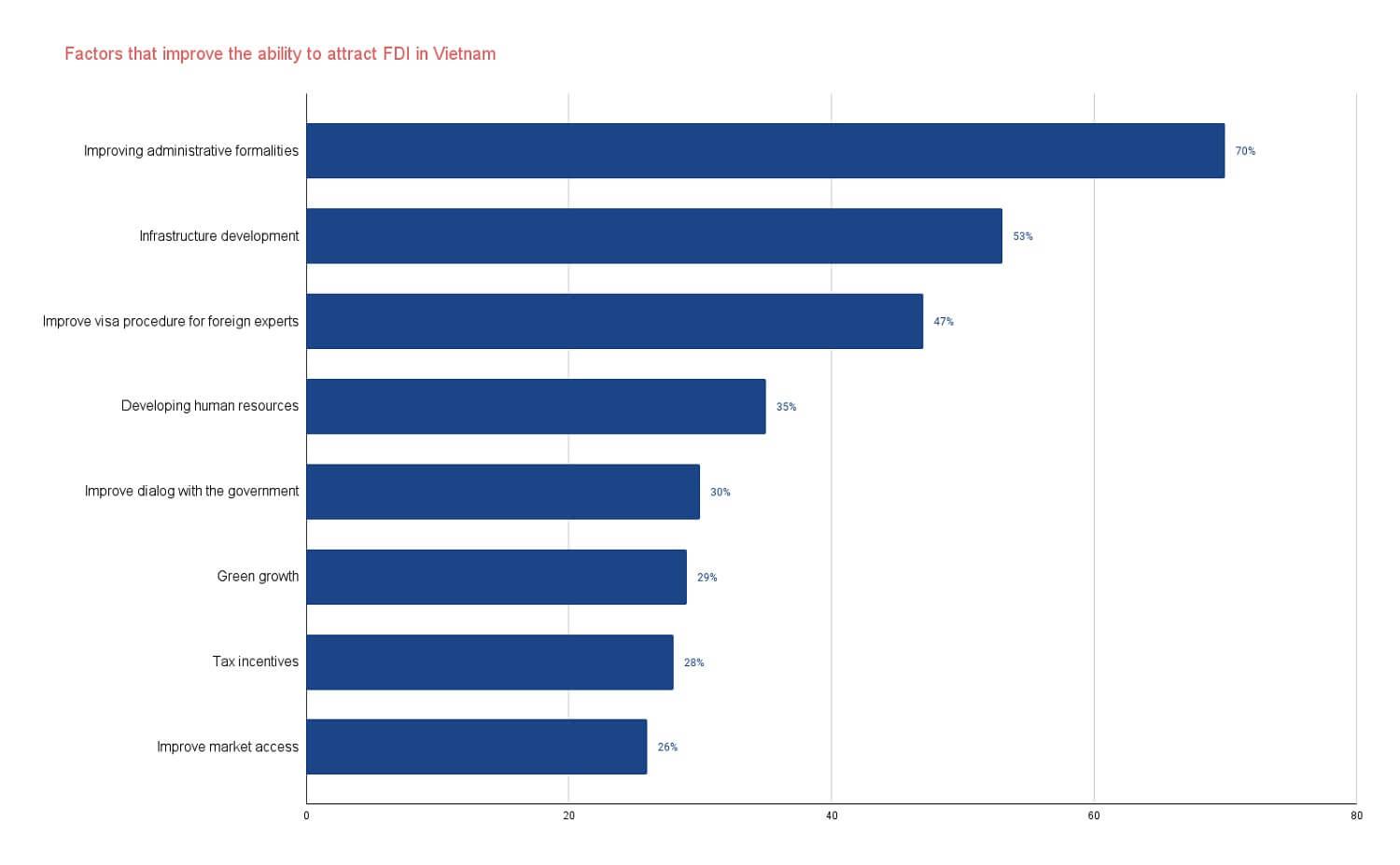

The implementation of the global minimum tax presents Vietnam with opportunities to upgrade its administrative formalities and infrastructure. According to the EuroCharm report in the fourth quarter of 2022, the majority of FDI enterprises from Europe expect Vietnam to strengthen administrative procedures (70%) and infrastructure development (53%) to attract FDI enterprises. At the same point of view, the Saigontimes assumed that to retain foreign enterprises, Vietnam needs to radically reform the investment environment including streamlining administrative formalities, developing infrastructure, focusing on supporting industry development, and improving the quality of human resources,…

Investment environment and elements to improve to attract FDI

(Data source: Saigontimes and EuroCham2022)

Sources: Saigontimes, Financial & Monetary Market Review, General Statistic Office, VnEconomy, VTV

The article was made by the content team of DELCO Construction. The copyright of the article on the delco-construction.com website belongs to DELCO Construction. Please do not copy or modify any content without the written consent of DELCO