From July 1, 2025, a series of new regulations related to the taxes in Vietnam such as value added tax (VAT), corporate income tax (CIT), digital platform tax, … will officially take effect, directly impacting FDI enterprises in Vietnam.

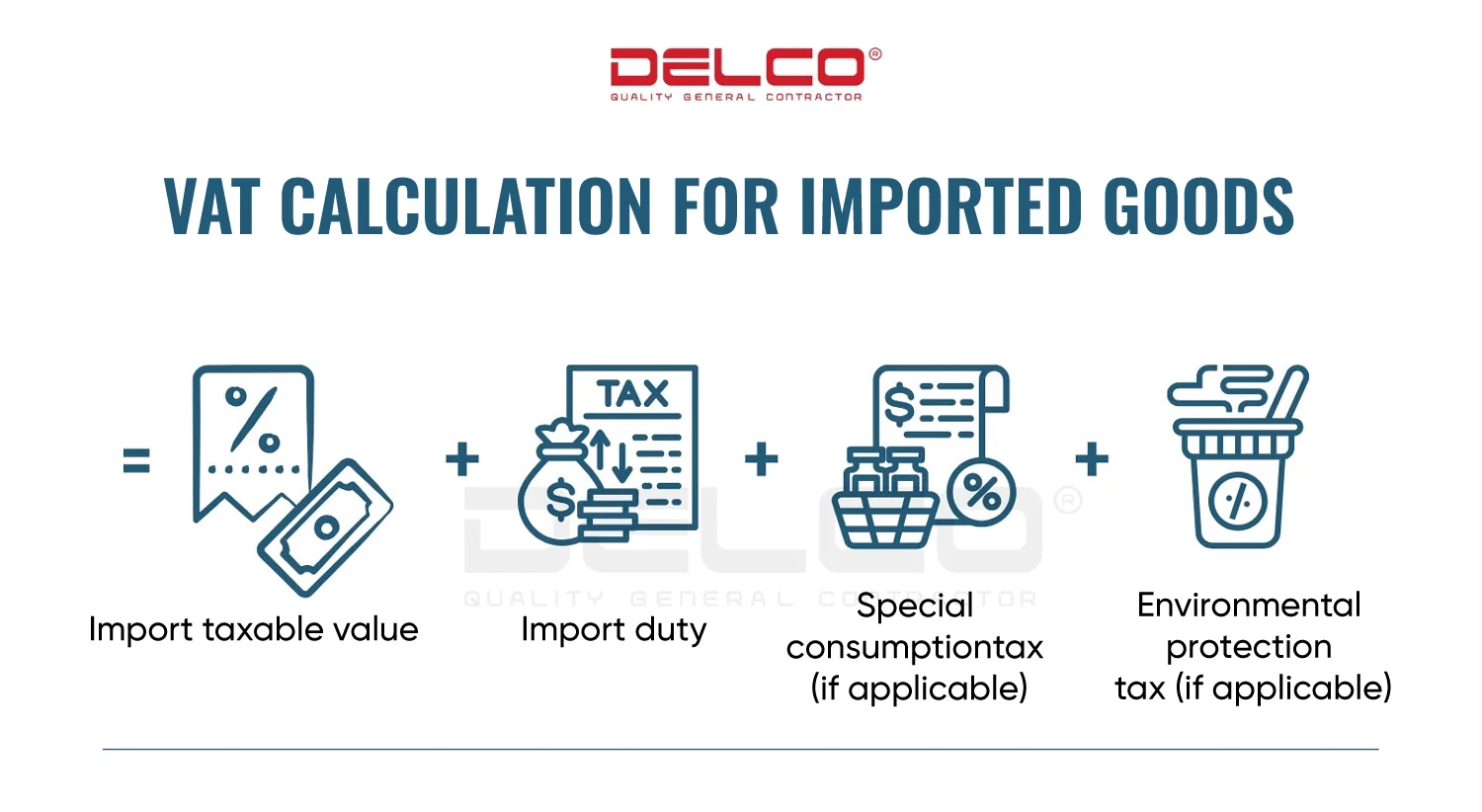

VAT calculation for imported goods

New regulation

Instead of being based on the “import price at the border gate” as before, the VAT taxable price for imported goods will now be calculated based on the “import taxable price” plus import duty, special consumption tax, and environmental protection tax (if applicable).

Impact on FDI investors

- This new method is more transparent and consistent, improving alignment with other related laws such as the Law on Import and Export Duties and customs valuation rules.

- For FDI enterprises with global supply chains, this change enables more accurate cost forecasting and helps minimize risks during tax audits.

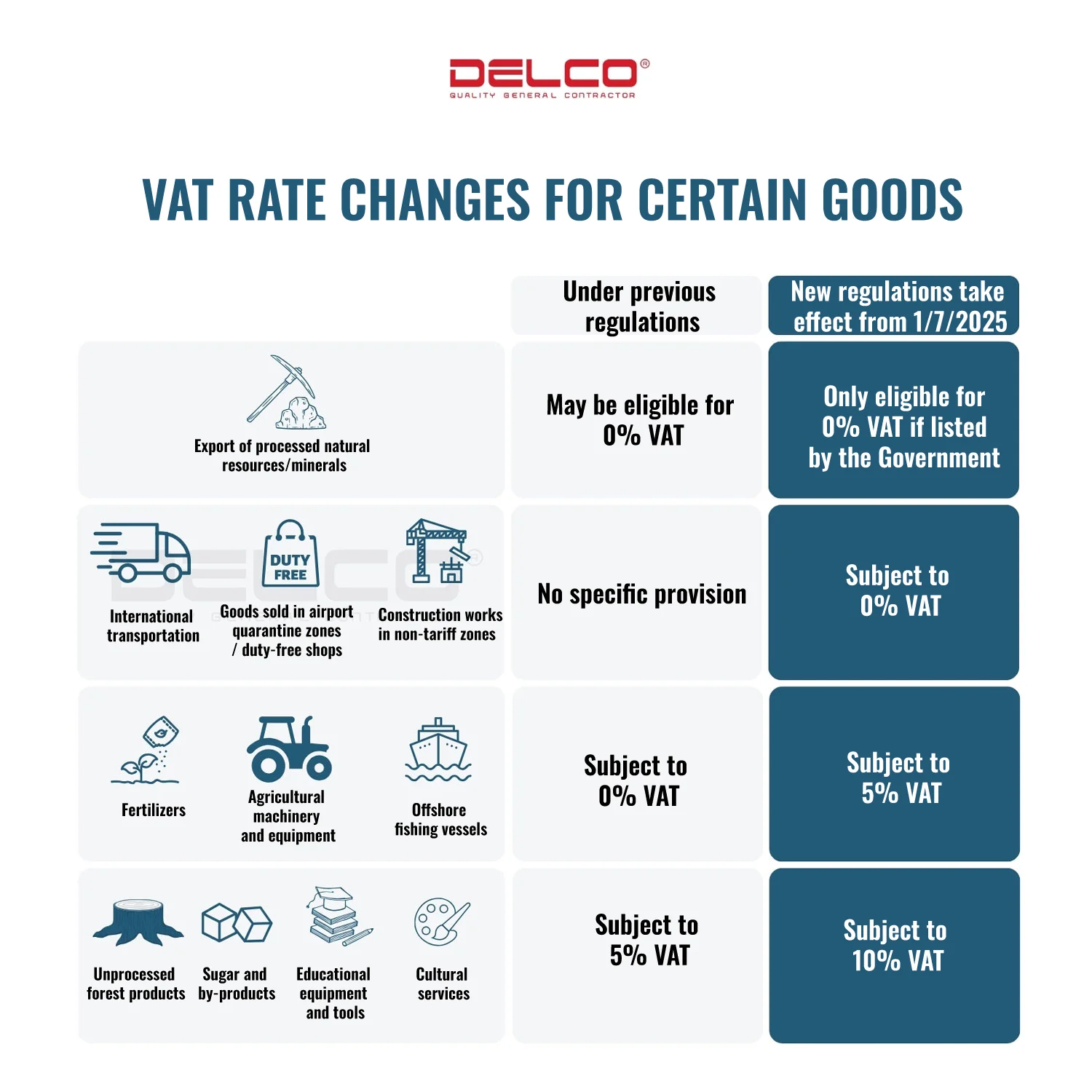

Adjustment of VAT rates for certain goods and services

New regulation:

Several groups of goods and services have been added to the list eligible for the 0% VAT rate. At the same time, some items will see their VAT rates adjusted—from 0% to 5%, or from 5% to 10%.

Impact on FDI investors

- These adjustments could have a direct impact on pricing strategies and business competitiveness.

- FDI enterprises in sectors such as logistics, duty-free retail, and non-tariff zone infrastructure may benefit directly from the 0% rate.

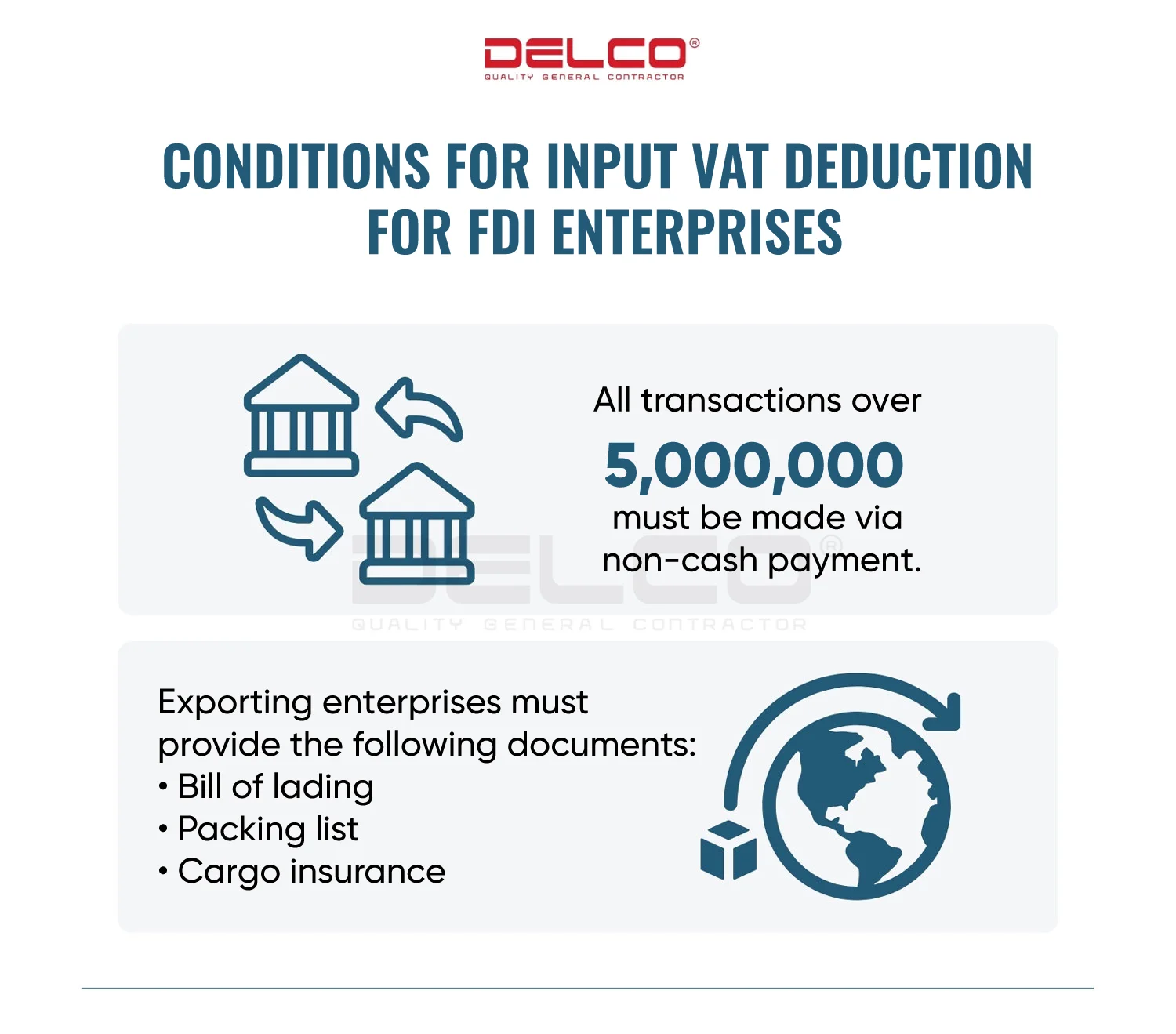

Changes to VAT deduction conditions

New regulation:

- All transactions over VND 5 million must be settled via non-cash payment methods.

- Exporting enterprises are now required to provide additional documents such as bills of lading, packing lists, cargo insurance, etc.

Impact on FDI investors

- These changes promote transparency, reduce tax fraud, and lower the risk of tax reassessment.

- This is especially beneficial for exporting companies with complex supply chains.

Expansion of VAT refund eligibility

New regulation:

Enterprises that produce only goods subject to the 5% VAT rate and have accumulated non-deductible input VAT of at least VND 300 million over 12 months or 4 consecutive quarters will be eligible for VAT refunds.

Impact on FDI investors

- FDI businesses in sectors such as high-tech agriculture, pharmaceuticals, medical equipment, and education may benefit from improved cash flow, better liquidity, and reduced financial pressure.

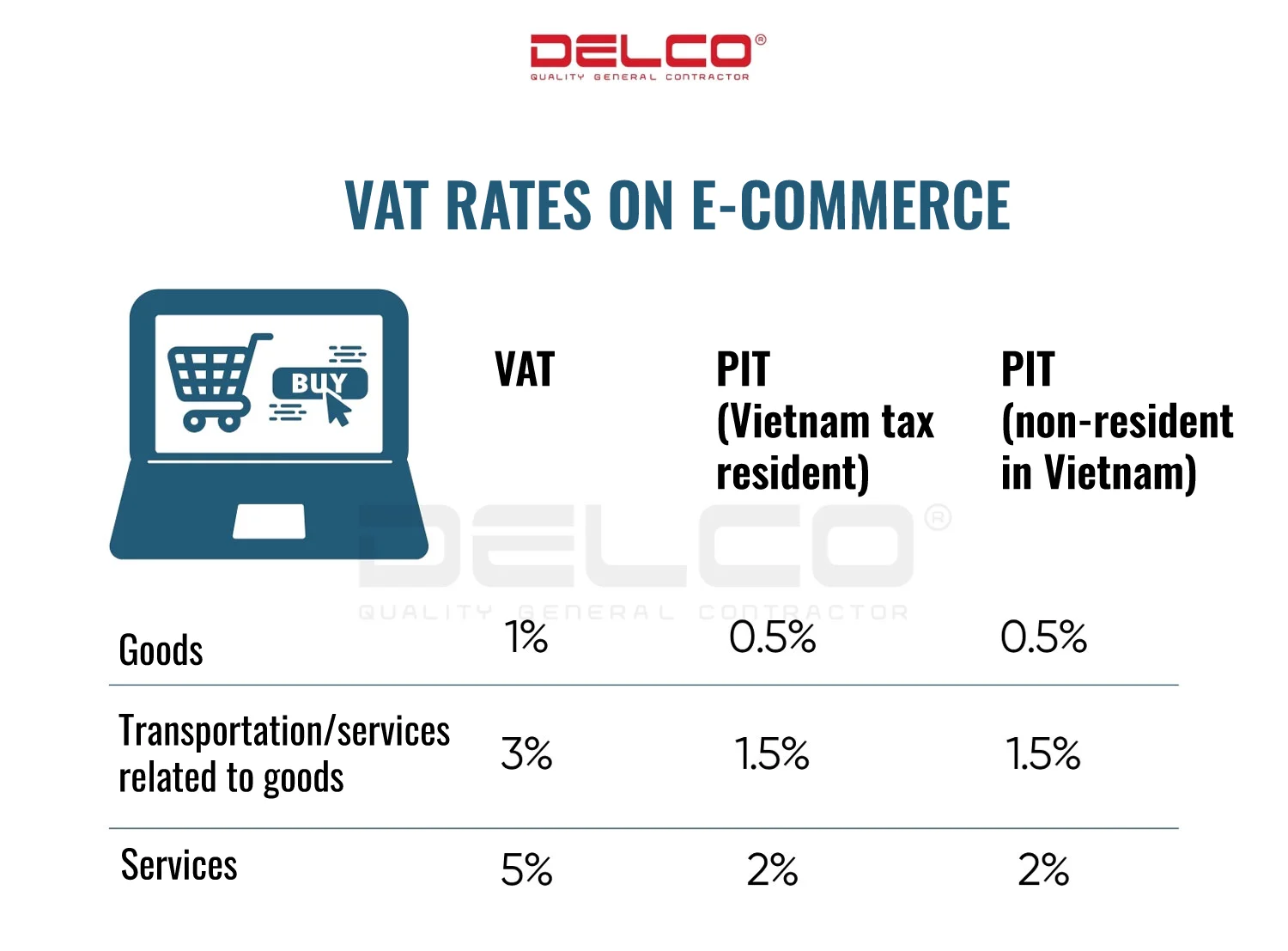

Tax administration on e-commerce platforms

New regulation:

E-commerce platforms such as Shopee, Lazada, Tiki, and TikTok Shop will be responsible for collecting and paying VAT and personal income tax (PIT) on behalf of individual sellers.

Impact on FDI investors

- This simplifies the tax declaration process for FDI enterprises operating in the e-commerce sector.

- It also enhances tax transparency and fosters a fair competitive environment between FDI and domestic businesses, as well as between large enterprises and small individual sellers.

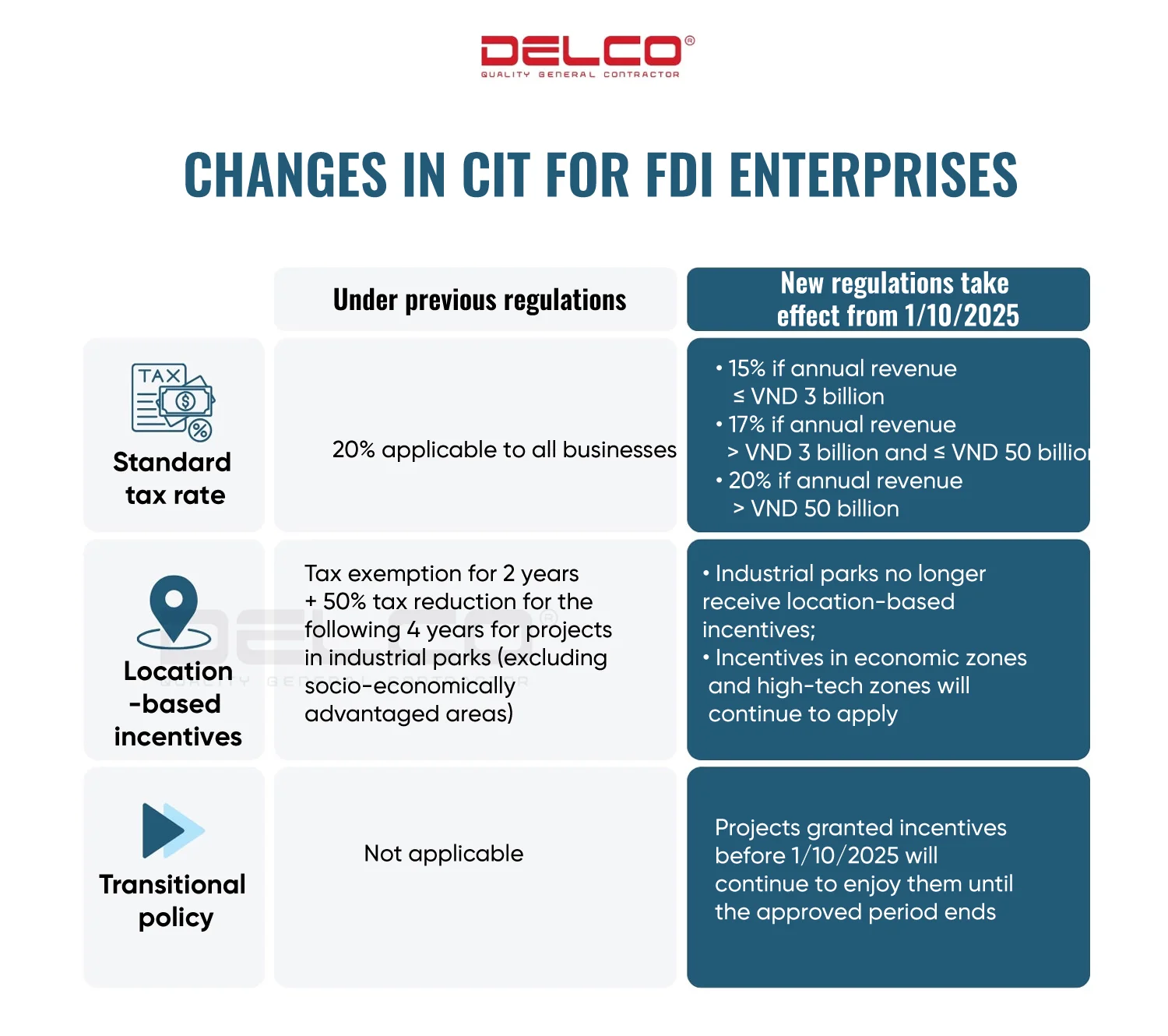

Corporate income tax (CIT)

New regulation:

- Starting from the 2025 tax year, Vietnam will implement a progressive CIT system based on revenue levels, replacing the flat 20% corporate tax rate.

- Location-based incentives in industrial parks will be removed, while industry-based incentives and those for specific economic zones or high-tech parks will remain.

Impact on FDI investors

- This change reflects Vietnam’s shift toward a more selective FDI approach—favoring high-tech, large-scale, and high value-added projects.

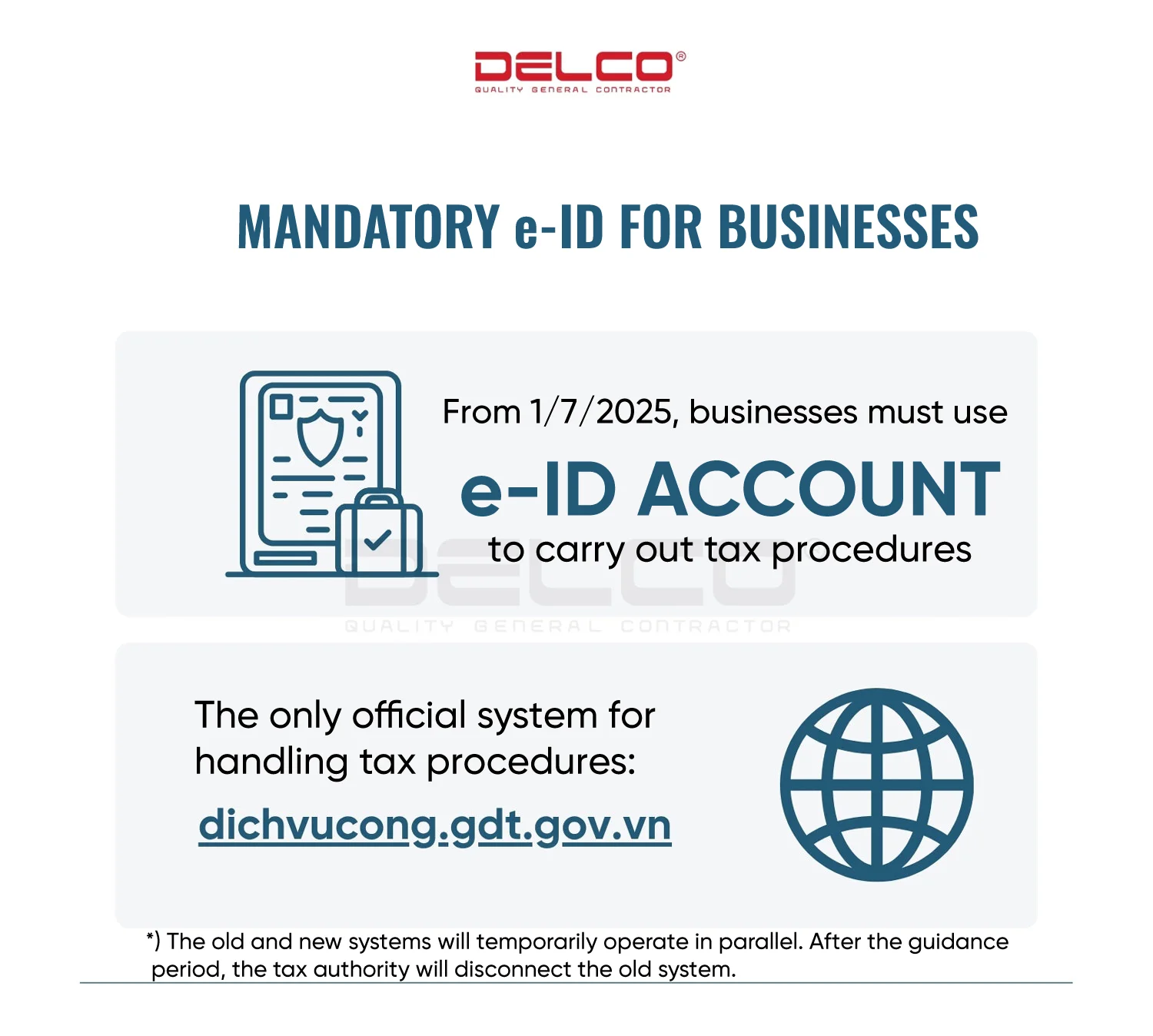

Mandatory e-identification for businesses

New regulation:

- From 1/7/2025, all businesses will be required to use an electronic identification (e-ID) account issued by the Ministry of Public Security to carry out tax and administrative procedures.

- A centralized system for handling all tax-related administrative procedures: dichvucong.gdt.gov.vn will replace previous systems such as eTax and tax agent platforms.

Impact on FDI investors

- This helps reduce time and costs, limits the need for in-person interactions with authorities, and increases transparency in fulfilling tax obligations.

Source: Vietnam Customs Department, Lao Động Newspaper

See also: Major changes after Vietnam’s provincial merger in 2025

See also: Top 5 ideal locations for factory investment in Vietnam after July 1, 2025

See also: Procedures for establishing a foreign-invested company in Vietnam