In recent years, Vietnam has been assessed to be an attractive FDI market. In addition to incentive policies, investors should learn about and understand the procedures for establishing a foreign-owned company in Vietnam to make investments fastest and most effectively.

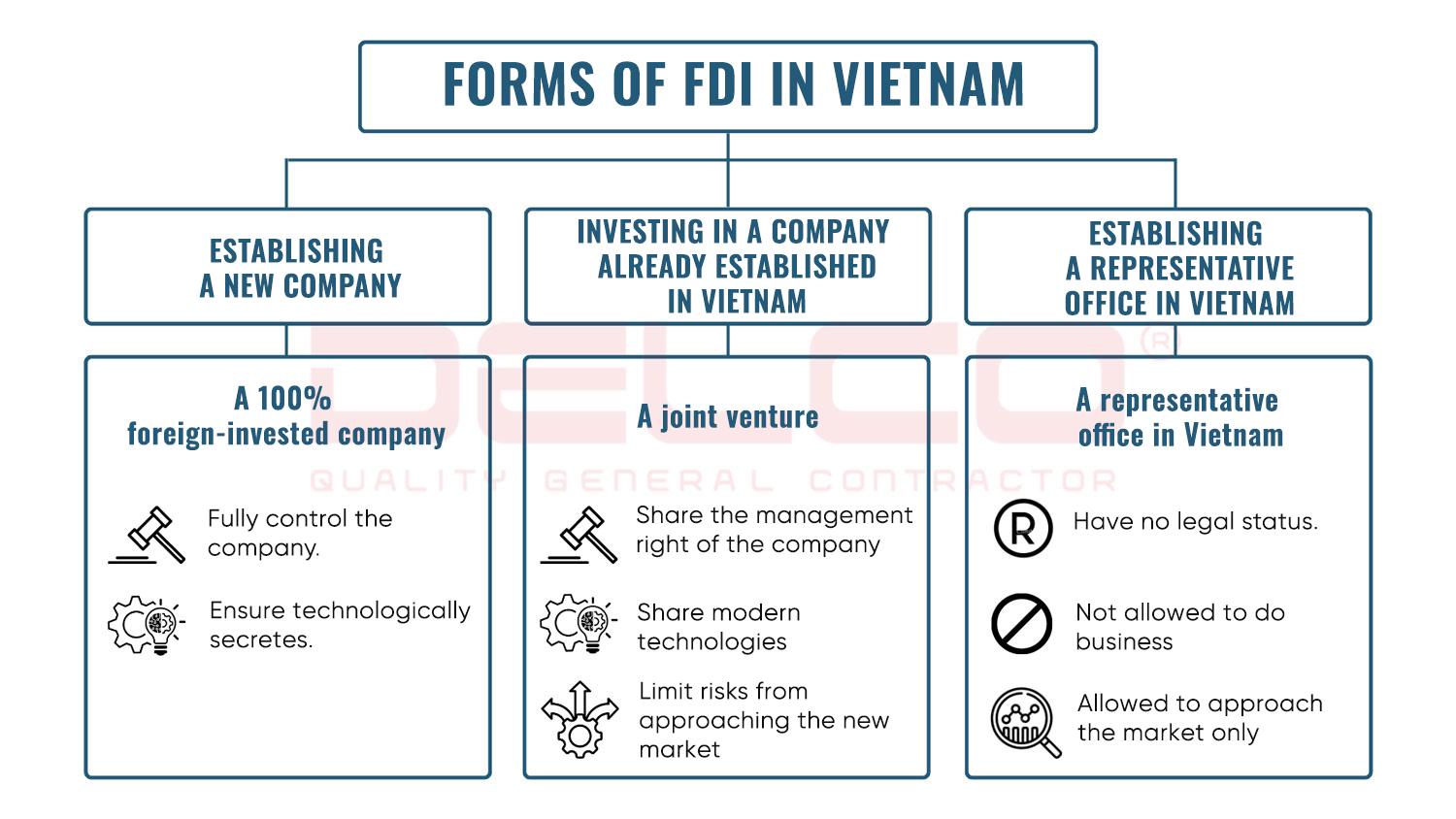

Popular forms of foreign direct investment in Vietnam

The 3 most popular forms of foreign direct investment in Vietnam include:

- A 100% foreign-invested company: Investors have the full right to decide on all business activities of the company, keeping confidential the business methods and technological secrets.

- A foreign invested joint venture: The participation in enterprise management, profit rate as well as risks of each party of the joint venture depends on their capital contribution ratio. This form of investment helps limit risks from approaching the new markets, and the investors can effectively use the available resources of Vietnamese companies, including: human resources, machines, equipment and customer relationship, etc.

- A representative office in Vietnam is one of the popular forms of investment with simple procedures, so it is often selected by the investors during the market research stage. The representative office acts as a contact point between the Parent Company abroad and customers in Vietnam, promoting business investment opportunities, but not carrying out profitable business activities.

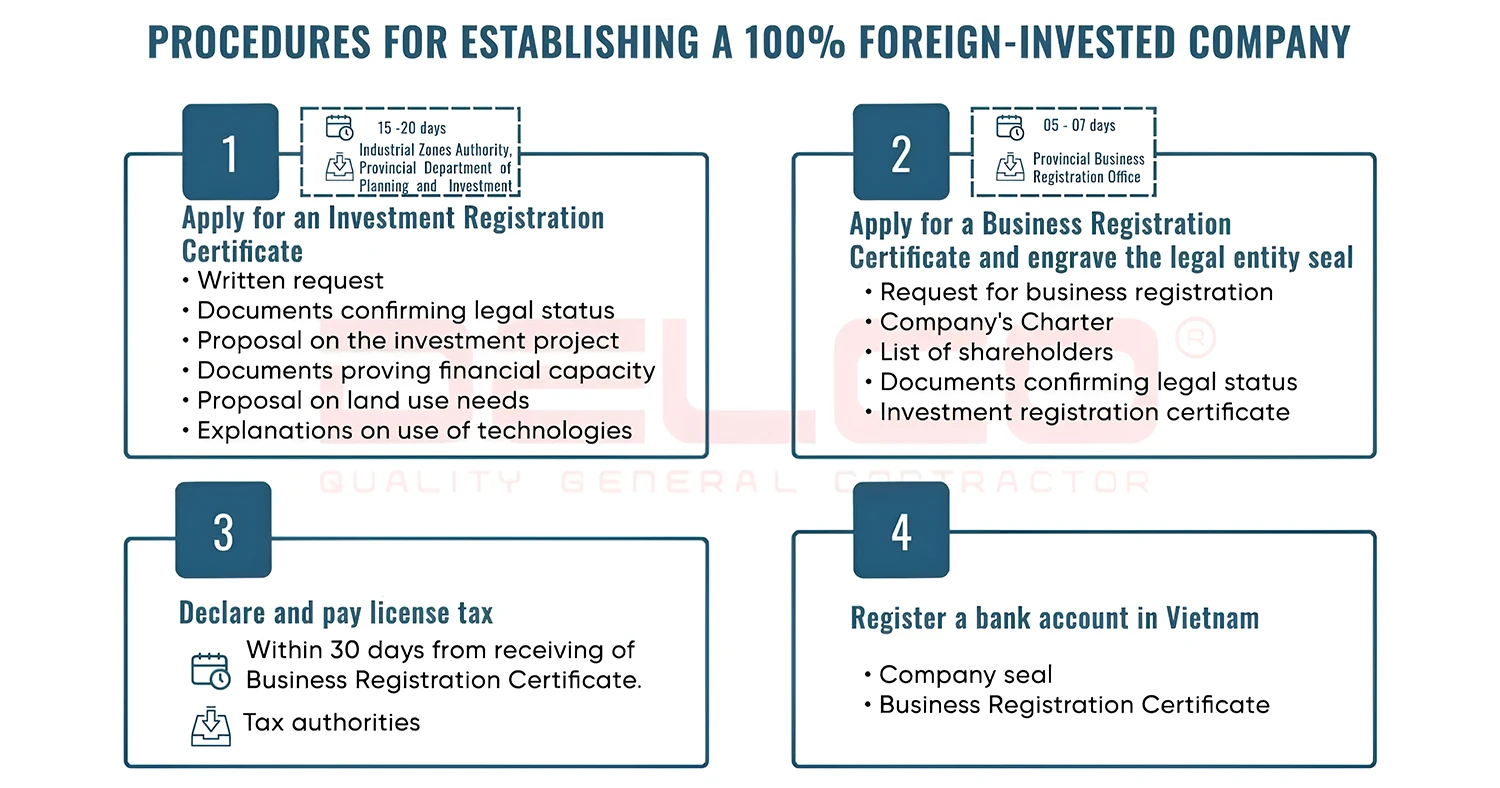

Procedures for establishing a 100% foreign-invested company

- The Investment Certificate is a mandatory document for foreign investors to be allowed to contribute capital into production and business activities in the territory of Vietnam.

- The Business Registration Certificate certifies the legal status of an enterprise in Vietnam. After receiving the Business Registration Certificate, foreign investors are allowed to carry out registered business activities.

- The investors must declare and pay license tax within 30 days of receiving the business registration certificate. The tax amount is based on the registered capital.

- The enterprise will register a bank account in Vietnam to perform transactions.

Total period for performing procedures: 3-4 months

Tax obligations:

- License tax

- Declare annual tax, pay value added tax, corporate income tax

Procedures for establishing a joint venture with foreign capital contributions

In case foreign and Vietnamese investors contribute capital and establish a foreign invested company based on a business cooperation contract: the procedures are similar to those for establishing a 100% foreign-invested company.

In case a foreign investor purchases shares or capital contribution from a Vietnamese company:

- Register the share and capital contribution purchase at the Department of Planning and Investment and obtain approval, then the investor can legally contribute capital to the Vietnamese company.

- The investor purchases shares or capital contributions and appoints a representative to manage such capital contribution in Vietnam.

- Business registration change is a procedure to recognize the capital contribution by the foreign investor and to change the enterprise form from a Vietnamese company to a joint venture with foreign capital contributions.

Total period for performing procedures: 3-4 months

Tax obligations:

- License tax

- Declare annual tax, pay value added tax, corporate income tax

Procedures for establishing a representative office in Vietnam of a foreign-invested company

- The license for establishment of a representative office is a legal basis for the foreign investor to conduct market research and organize trade promotion activities in Vietnam.

- The seal is engraved and the round seal sample of the representative office is registered at the Provincial Department of Planning and Investment.

- The representative office must register its tax code to fulfill tax obligations.

- The representative office must open an account at a bank licensed to operate in Vietnam to be able to receive cash from the parent company abroad and pay salaries to employees and other operating expenses.

Total period for performing procedures: 6 – 8 weeks

Tax obligations:

- License tax

- Personal income tax for employees of the Representative Offices.

- It is not required to declare, calculate and pay value added tax or corporate income tax

Each form of investment, whether establishing a foreign-invested company or a representative office in Vietnam, has different advantages and disadvantages and implementation processes. Understanding and implementing the correct processes will help investors save time and investment costs.

With 15 years of experience in the field of Industrial Construction, cooperating with many FDI enterprises from Italy, Japan, Korea, etc., DELCO can advise investors on the appropriate investment processes for each project, simplifying procedures and saving costs.

See more: Experience in establishing a company in Vietnam

See more: Procedures for leasing industrial land in Vietnam for FDI enterprises