From 2026, the adjustment of the regional minimum wage will change the statutory base salary used to calculate compulsory social insurance (SI). This directly affects personnel costs and financial planning for FDI enterprises operating in Vietnam.

Changes in the basis for social insurance contributions

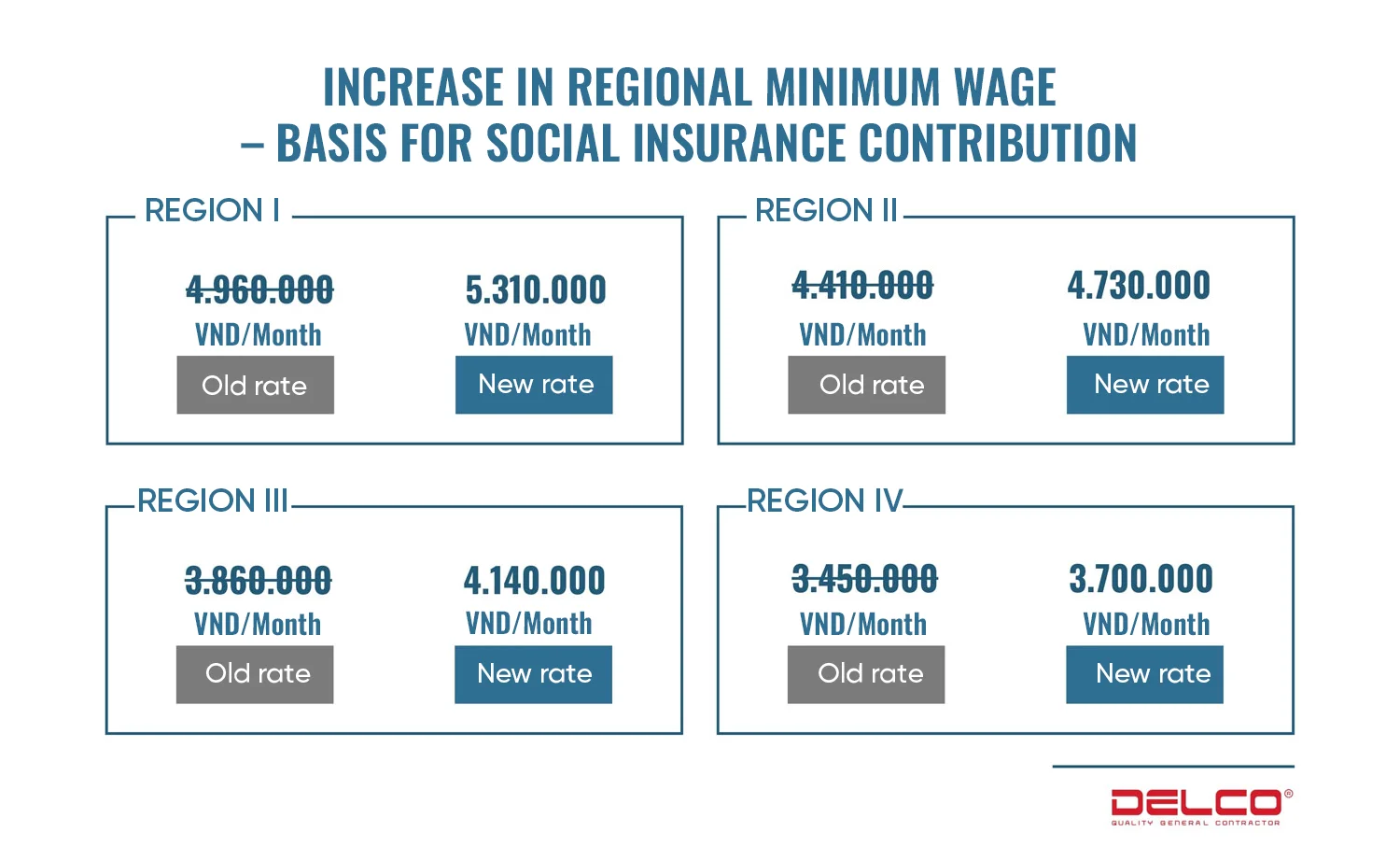

According to Decree 293/2025/NĐ-CP, from January 1, 2026, the regional minimum wage — which serves as the basis for determining the compulsory SI contribution — will be adjusted as follows:

- Region I: VND 5,310,000/month

- Region II: VND 4,730,000/month

- Region III: VND 4,140,000/month

- Region IV: VND 3,700,000/month

For most FDI manufacturers, actual wages paid to workers are already higher than the minimum wage in their region. Therefore, the 2026 wage adjustment will not significantly impact the payroll budget, but it may slightly increase the employer’s total SI contribution.

Minimum social insurance contributions from Jan 1st 2026

Under the Social Insurance Law, employers must contribute a total of 21.5% of each employee’s salary to various funds, including retirement, health insurance, and unemployment insurance. Based on the updated minimum wages, the minimum amount companies will need to contribute per employee is as follows:

| Region | Minimum Monthly SI Contribution Base (VND) | Minimum Employer Contribution (21.5%) (VND) |

| I | 5.310.000 | 1.141.650 |

| II | 4.730.000 | 1.016.950 |

| III | 4.140.000 | 890.100 |

| IV | 3.700.000 | 795.500 |

In practice, enterprises may be applying different salary structures, especially in the separation of base salary, allowances, and supplementary payments. When the regional minimum wage changes, companies must reassess their salary framework to ensure the SI-contributable salary complies with the new regulations and is not set below the statutory threshold.

Source: Tuổi Trẻ

See more: Basic salary: How the minimum wage increase affects the labor market

See more: Proposal to increase Vietnam’s base salary: Impacts on foreign investors