Foreign direct investment (FDI) investors need to understand the mandatory taxes in Vietnam as well as the applicable tax incentive policies to facilitate their business operations in the country.

Corporate income tax (CIT)

Applicable entities: CIT is imposed on income generated from production, business activities, and other sources of income by enterprises.

Tax calculation method:

CIT Payable=Assessable Income×Tax Rate

Assessable Income = Revenue−Deductible Expenses+Other Income−Exempt Income−Loss Carried Forward

Tax rates: The standard CIT rate for businesses in Vietnam is 20%. The CIT rate for enterprises in exploration and mining of petroleum, gas and other rare and precious natural resources ranges from 32% to 50%

Tax declaration and payment deadlines

- Annually: The last day of the 3rd month following the end of the tax year.

- Upon occurrence: 10th day from the occurrence of tax obligations

- Enterprises are required to make quarterly provisional CIT payments. The total provisional tax paid during the four quarters must account for at least 80% of the final tax amount determined in the annual tax settlement.

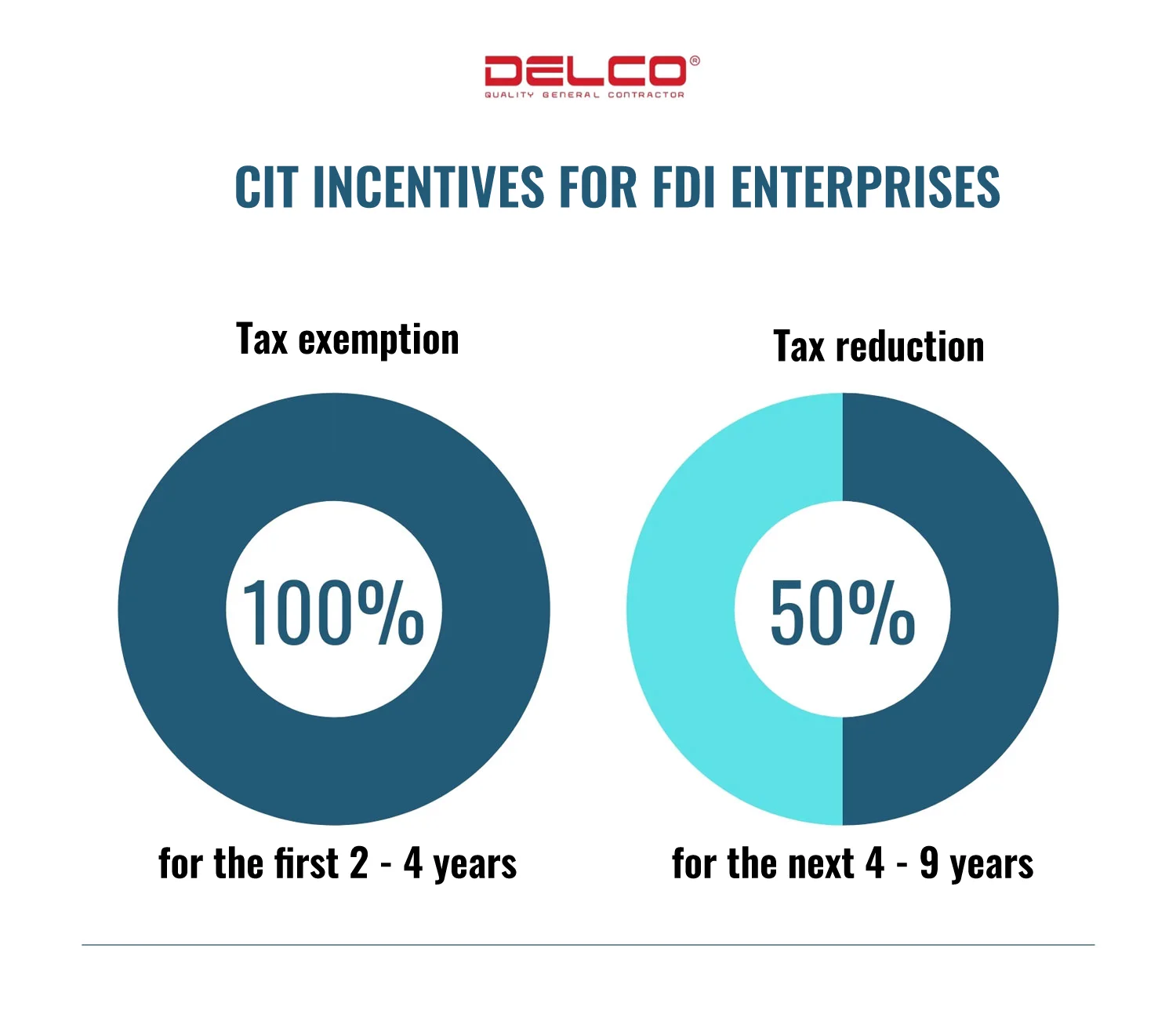

CIT incentives for FDI enterprises

CIT exemption and reduction policies are a key factor in attracting FDI enterprises to Vietnam. These incentives not only help businesses optimize costs but also encourage investment in underdeveloped areas or priority industries, such as high technology, clean energy, and supporting industries. The flexible policies enable enterprises to access these opportunities easily, even at the early stages of their operations.

Vietnam offers numerous CIT incentives for FDI enterprises, including exemptions and reductions based on investment location and business sector. Details are as follows:

| Activities | Level of CIT incentives | ||

| Tax rate | Miễn / giảm thuế | ||

| By location | Areas with especially difficult socio-economic conditions Economics zones High-tech zones | 10% for 15 years | 4 years of tax exemption; and 50% reduction for the next 9 years |

| Areas with difficult socio-economic conditions | 17% for 10 years | 2 years of tax exemption; and 50% reduction for the next 4 years | |

| Industrial parks (not located in a favorable socio-economic location) | Not applicable | 2 years of tax exemption; and 50% reduction for the next 4 years | |

| By Sector |

| 10% for 15 years | 4 years of tax exemption; and 50% reduction for the next 9 years |

| Farming, husbandry, processing of agriculture and aquaculture in difficult regions; preservation of agriculture products, aquaculture products and foods, etc. | 10% for whole project’s duration | Not applicable | |

| Farming, husbandry, processing of agriculture and aquaculture products not located in difficult and especially difficult regions. | 15% for whole project’s duration | Not applicable | |

| Manufacturing of high-grade steel, energy saving products, machinery and equipment serving agriculture, forestry, fisheries and salt production, traditional crafts, etc. | 17% for 10 years | 2 years of tax exemption and 50% reduction for the next 4 years | |

***In several provinces such as Hung Yen, Hai Duong, Bac Ninh, etc., special CIT incentive policies are available for FDI investors. Enterprises can enjoy a CIT rate of 10% for up to 15 years, 100% tax exemption for the first 2–4 years, and a 50% tax reduction for the following 4–9 years. This summary does not include specific tax exemptions and reductions unique to each locality, which may vary depending on provincial regulations.

Value-added tax (VAT)

Applicable entities: VAT applies to most goods and services consumed in Vietnam.

Tax calculation method: Currently, VAT in Vietnam is calculated using two methods:

Credit Method:

VAT Payable = Output VAT − Input VAT

| Input VAT | Output VAT |

| Total VAT on goods or services sold Tax rate:

|

Direct method: VAT Payable=Revenue×Tax Rate

| Tax rate | 1% | Distribution; supply of goods |

| 2% | Other cases | |

| 3% | Manufacturing; transportation; services attached to the supply of goods; construction, including supply of materials | |

| 5% | Services; construction excluding supply of materials |

Tax declaration and payment deadlines:

- Monthly: 20th day of the following month.

- Quarterly: The last day of the month following the end of the quarter

- Upon occurrence: 10th day from the occurrence of tax obligations

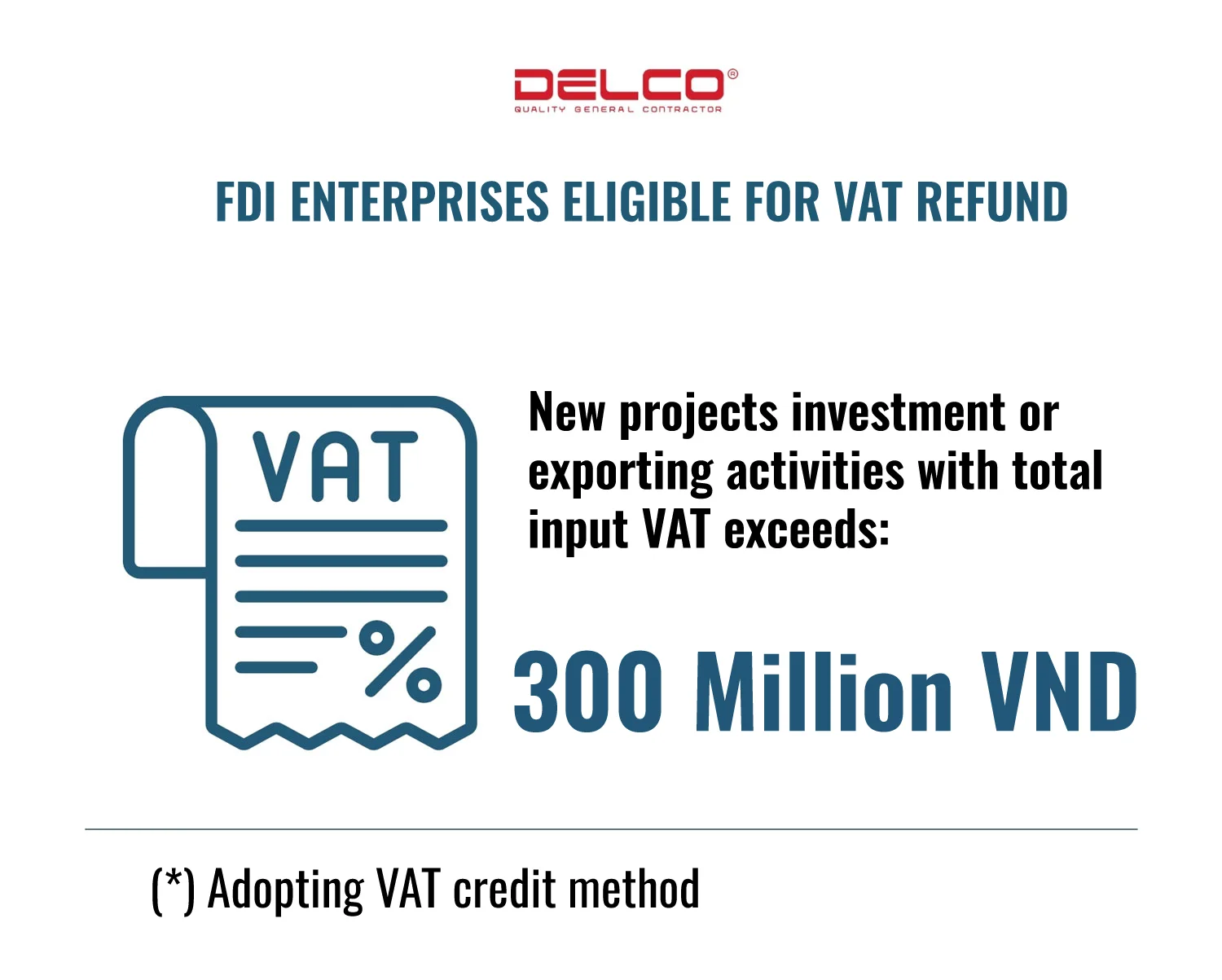

List of cases can claim VAT refunds

| No. | Cases | Conditions for tax refund |

| 1 | New projects investment |

|

| 2 | Exporting activities |

|

| 3 | Business | Conversion, merger, consolidation, division, dissolution, bankruptcy or shutdown |

| 4 | Other cases |

|

Foreign contractor withholding tax (FCWT)

Applicable entities: Foreign contractors provide goods and services to Vietnamese enterprises.

Tax calculation method:

FCWT comprises both a CIT and VAT component. The filing and calculation of FCWT is based on one of three methods:

| Criteria | Deemed method | Declaration method | Hybrid method |

| Filing | Vietnamese Party | Foreign Contractor | Foreign Contractor |

| Calculation | VAT = Revenue subject to VAT x deemed rate CIT = Revenue subject to CIT x deemed rate | VAT = Output VAT – Input VAT (*) Credit method CIT = Assessable income x CIT rate (*) same as a domestic corporation | VAT = Output VAT – Input VAT (*) Credit method CIT = Revenue subject to CIT x deemed rate |

| Revenue/ Profit remittance | Tax liability must be withheld before remittance | No detailed requirement | No detailed requirement |

Tax rate: For the deemed method, different tax rates apply depending on the type of business activity.

| Business activities | VAT rate | CIT rate |

| Supply of goods in Viet Nam or the goods are associated with services rendered in Viet Nam (including on-spot export and import, distribution of goods in Viet Nam) | Exempt | 1% |

| Services, leasing of machinery and equipment | 5% | 5% |

| Supply of goods attached to services where the value is separated (Income from services) | 5% | 5% |

| Supply of machinery and equipment with services attached where the value is not separated | 3% | 2% |

| Construction, installation inclusive of raw materials, machinery and equipment | 3% | 2% |

Tax declaration and payment deadlines

- Monthly: 20th day of the following month.

- Upon occurrence: 10th day from the occurrence of tax obligations

Personal income tax (PIT)

Applicable entities: Personal income tax in Vietnam is levied on the income of individuals working in Vietnam. The PIT may be paid by the enterprise, or jointly by the enterprise and the employee, depending on the agreement between the two parties.

Tax calculation method:

PIT Payable = (Total Taxable Income – Deductions) × Progressive Tax Rate

Deductions:

● Family relief

● Compulsory insurances

● Voluntary pension contribution

● Charitable/humanitarian contributions

Tax rate:

| Monthly assessable income (VNĐ) | Residents | Non-residents |

| Below 5 million | 5% | 20% |

| 5 – 10 million | 10% | |

| 10 – 18 million | 15% | |

| 18 – 32 million | 20% | |

| 32 – 52 million | 25% | |

| 52 – 80 million | 30% | |

| Above 80 million | 35% |

Tax declaration and payment deadlines:

| No. | Tax procedures | Deadlines |

| 1 | Tax registration | Within 10 working days from the date the individual incurs tax obligation |

| 2 | Monthly tax filing and payment | By the 20th day following the reporting month |

| 3 | Quarterly tax filing and payment | By the end of the month following the reporting quarter |

| 4 | Year-end finalization filing and payment (withholding tax return) | By the last day of the third month from the end of the tax year |

| 5 | Year-end finalization filing and payment (direct filing) | By the last day of the fourth month from the end of the tax year (for tax year being the calendar year). By the last day of the third month from the end of the tax year (for other tax years). |

| 6 | End of assignment finalization and payment | Prior to leaving Viet Nam or within 45 days from the repatriation from Viet Nam in case of authorization |

| 7 | Submission of dependent registration | By 31 December of the year |

Import/Export duties

Applicable entities: Export/import tax applies to enterprises or individuals engaged in the import or export of goods in Vietnam.

Tax calculation method:

Export/Import Tax Payable=Actual Quantity Exported/Imported×Taxable Unit Price×Tax Rate

Tax rate:

- Export Tax: Most exported goods are exempt from tax; however, some items such as natural resources, wood, and metal scraps are subject to tax rates ranging from 0% – 40%.

- Import Tax: Tax rates vary depending on the type of goods and country of origin:

- Consumer goods, especially luxury goods or goods that Vietnam can produce domestically, are subject to very high tax rates, which can reach up to 150%.

- Machinery, equipment, and production materials enjoy low import tax rates or exemptions.

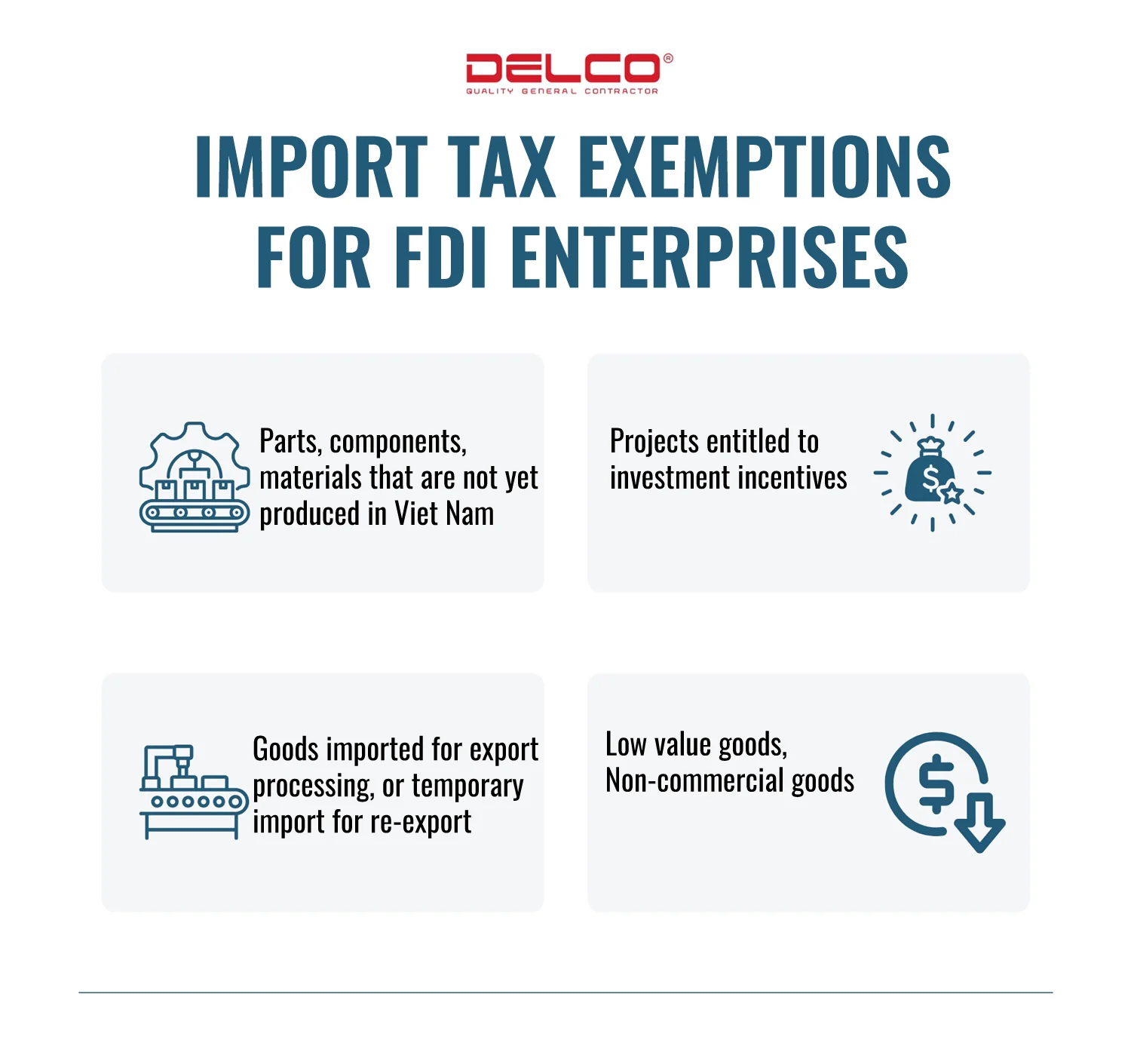

Import tax incentives for FDI enterprises:

- Parts, components, materials that are not yet produced in Viet Nam imported for the assembly of automobiles, oil and gas or shipbuilding activities, IT activities, environment protection activities, R&D, etc.

- Projects entitled to investment incentives:

- Machinery and equipment imported to form fixed assets of the projects;

- Materials and parts that are not yet produced in Viet Nam imported to serve the manufacturing activity of the projects within 5 years from the date of production commencement.

- Goods imported for export processing, or temporary import for re-export.

- Low value goods: Gifts, Non-commercial goods, e.g., samples, models.

Tax declaration and payment deadlines: Vietnam’s customs regulations require taxes and fees to be paid before or immediately after customs clearance of goods.

Refunds:

- Import duties paid on imported goods which are later exported overseas or non-tariff zones

- Export duties paid on exported goods which are later re-imported

- Import duties paid on materials imported to produce goods that are subsequently exported

- Import/export duties paid on imported/exported goods but the goods are actually imported/exported with a quantity smaller than the quantity on which duty was paid

Business license fee (BLF)

Applicable entities:

The Business License Fee, also known as the BLF, is one of the most fundamental taxes in Vietnam, applied to all enterprises operating in the country.

Fee: ranges from 1 – 3 million VND per year, depending on the enterprise’s charter capital.

Tax payment deadline: Enterprises must pay the BLF no later than January 30 each year.

Source: EY Vietnam, FIA Vietnam

Xem thêm: Tax incentives for FDI businesses in Vietnam

Xem thêm: Foreign investment in Vietnam FAQs