Vietnam applies a tax rate of 0% on components, auto parts and Completely-built-up (CBU) cars from ASEAN and European countries. Vietnam’s automobile industry is forecasted to grow strongly and reach a scale of 700,000 – 800,000 vehicles/year by 2025 and over 1,000,000 vehicles/year by 2030.

Vietnam is a new potential market for FDI enterprises in the automobile industry

Up to now, the country has 377 automobile enterprises, including 169 foreign enterprises, accounting for 46.43% of the total number of automobile enterprises in Vietnam. Many big automobile companies have set up car manufacturing factories in Vietnam such as Hyundai of Korea; Honda, Toyota, Mitsubishi of Japan; Ford of America…

In particular, Vietnam become as a potential market for FDI investors as several automotive manufacturing and assembly factories are continuously built such as the Skoda factory with 100% investment of TC Group in Quang Ninh, Geleximco factory in Thai Binh with an investment of 7000 billion VND, Hyundai Thanh Cong Vietnam factory No. 2 in Ninh Binh with an investment of 3200 billion VND…

Delco is the general contractor of the IWASEYA factory project specializing in the production of automobile parts in Dinh Tram Industrial Park, Viet Yen, Bac Giang

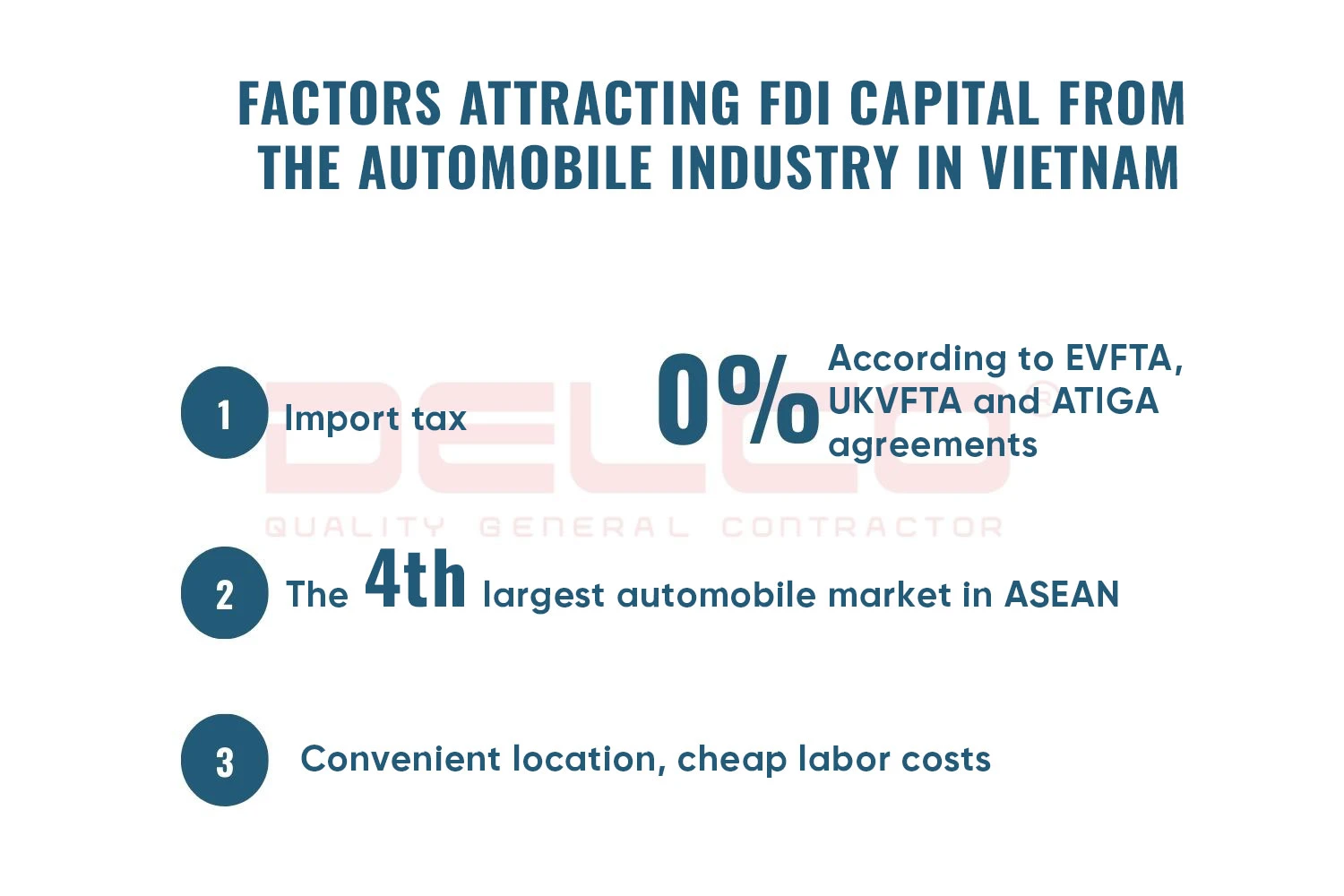

Why does Vietnam attract FDI capital flows in the automobile industry?

FDI investors choose to locate automobile manufacturing and assembly factories in Vietnam because Vietnam is one of the automobile markets with the highest potential growth in the world, with a car ownership rate reaching 50 vehicles/1000 people, an increase of 30.6% compared to 2020.

In addition, Vietnam’s participation in agreements such as EVFTA and UKVFTA has facilitated reduced import taxes for Vietnamese automobile enterprises when importing from EU countries, particularly with some components enjoying a 0% tax rate by 2027, such as spark plugs, tires, etc. Automobile components and spare parts from ASEAN countries when imported into Vietnam are also subject to a tax rate of 0% under the ATIGA agreement.

In addition, the US-China trade war and the Covid-19 pandemic also severely affected FDI automobile enterprises in China. China increased the export tariffs on cars made in the US from 15% to 40%. Besides, the Covid pandemic caused many automobile factories in China to be dissolved. Several big companies faced difficulties and withdrew from China. Meanwhile, Vietnam is a country bordering China, has a convenient transportation location and competitive labor costs. This is one of the important factors attracting FDI enterprises to join the Vietnamese automobile industry.

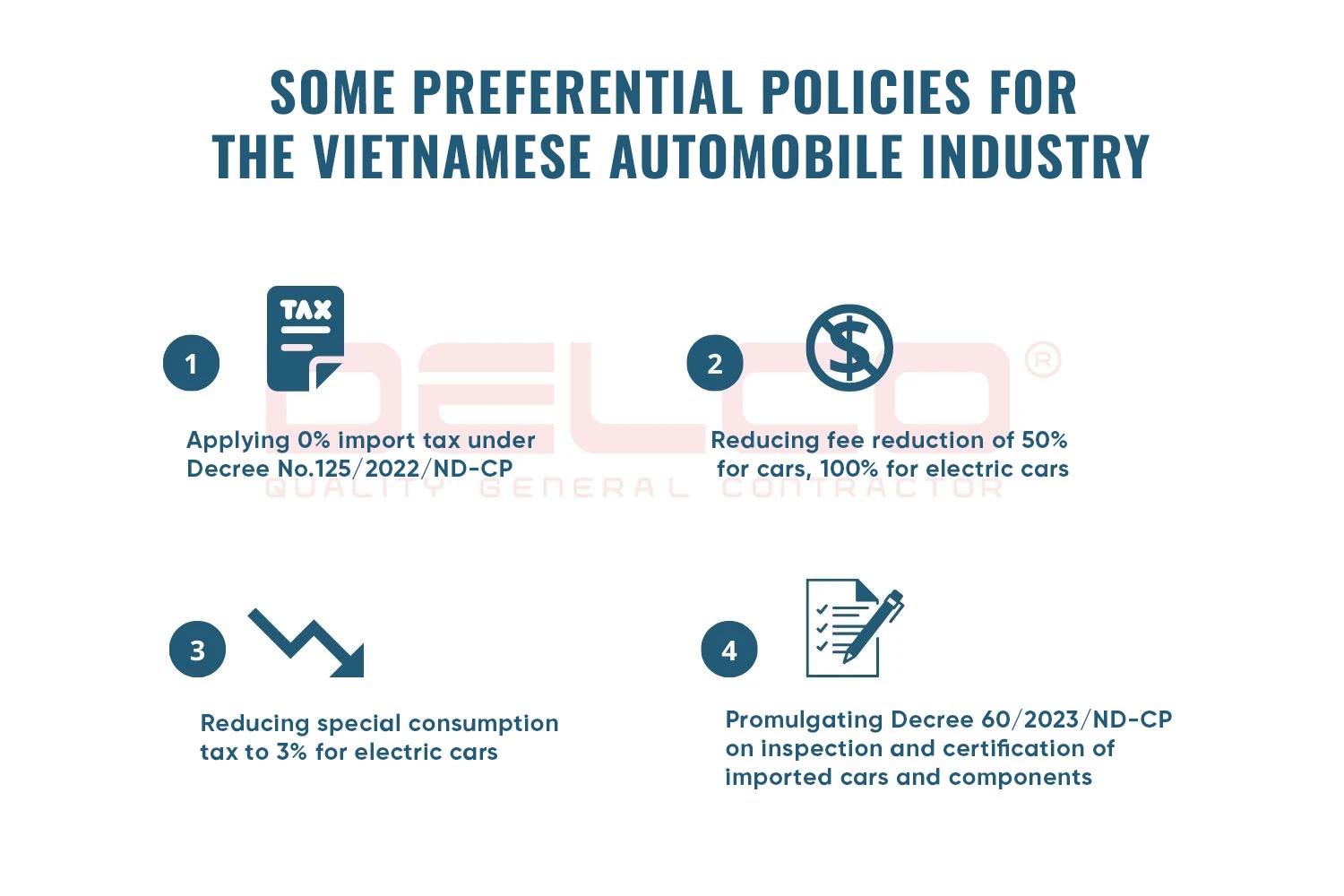

Preferential policies in Vietnamese automobile industry

According to the situation of Vietnam’s automobile industry, in addition to tax exemption and reduction policies under signed agreements, Vietnam also offers favorable policies and attractive incentives for the automobile industry including a 0% import tax on completely built-up vehicles imported from Thailand and Indonesia. Moreover, there is a tax exemption for spare parts imported from Korea according to Decree 125/2022/ND-CP, a 50% reduction in registration fees and extension of tax payment deadlines, etc.

Vietnam focuses on supporting and promoting the development of electric cars with special preferential policies such as policies to encourage the use of electric cars, 0% registration fee exemption for new cars, and special consumption tax reduction from 15% down to 3%.

In addition, according to the EVFTA, the countries which import electric vehicles have to accept the testing results and certification in the exporting countries. Therefore, the Government has issued Decree 60/2023/ND-CP which regulates the inspection and certification of technical safety and environmental protection for imported automobiles and components. This decree helps to facilitate the businesses in exporting goods to countries participating in the agreement.

Potential growth of Vietnam’s automobile industry in the future

The Government’s attractive preferential policies also strongly attract foreign automobile businesses. A number of typical large companies such as Toyota, Honda, Hyundai… have been expanding their production in Vietnam, leading to a lot of manufacturers supplying spare parts for the automobile industry to invest in Vietnam, contributing to the significant development of the Vietnamese automobile industry market.

The trend of automobile electrification is being promoted in Vietnam. Vinfast is a company which is a pioneer in leading the global trend of electric vehicles. Currently, this company has launched electric vehicles such as buses, cars, which have been well-received both domestically and internationally. In particular, Vinfast has received 65,000 electric vehicle orders in the US and numerous other orders in Canada and EU countries.

According to the Ministry of Industry and Trade, Vietnam is the 4th largest automobile market in ASEAN. Based on potential growth, orientation and forecasts of the Government, the Vietnamese automobile market will reach a scale of 700,000 – 800,000 vehicles per year by 2025 and over 1,000,000 vehicles per year by 2030. Besides, according to ZF Aftermarket’s assessment, the number of vehicles in Vietnam in the next 5 years will increase to 10%. By 2027, there will be a significant demand for purchasing spare parts in Vietnam, making it a golden opportunity for investors.

UTECH Vietnam factory – a vendor supplying devices and chemicals for automobile manufacturer in Vietnam, by DELCO as the Design – Build contractor

See more: List of industrial zones in Vietnam – 2023

See more: Vietnam’s GDP 2023 and 2024 growth forecast.