In 2023, FDI enterprises contributed $259.95 billion, accounting for 73.1% of the total export turnover. The export processing sector became the largest FDI attraction sector in Vietnam due to attractive tax incentives.

Vietnam attracts many FDI Export Processing Enterprises

According to statistics from the General Department of Customs, by December 2023, the country’s export value is 337.62 billion USD. Of these, 7 product groups belonging to the export processing sector with a turnover of over US $10 billion accounted for 66.8% of the country’s total export turnover, including: electronics and components; textiles, footwear, wooden furniture; machinery, equipment, tools and spare parts, computers, electronic products and components.

Large FDI projects have significantly contributed to Vietnam’s export processing sector and export turnover in recent years. In 2023, FDI enterprises contributed $259.95 billion, accounting for 73.1% of the total export turnover. In particular, Foreign-invested enterprises account for 99.6% in phones, over 98% in computers, 93% in machinery, and more than 60% in garments-textiles, etc.

Up to now, Vietnam has 414 industrial parks, including 4 export processing industrial parks established with a total land area of 128,126 hectares, attracting many large FDI enterprises setting up export processing factories such as Toyota, Samsung, Adidas, Apple…

Why do FDI enterprises invest in the export processing sector in Vietnam

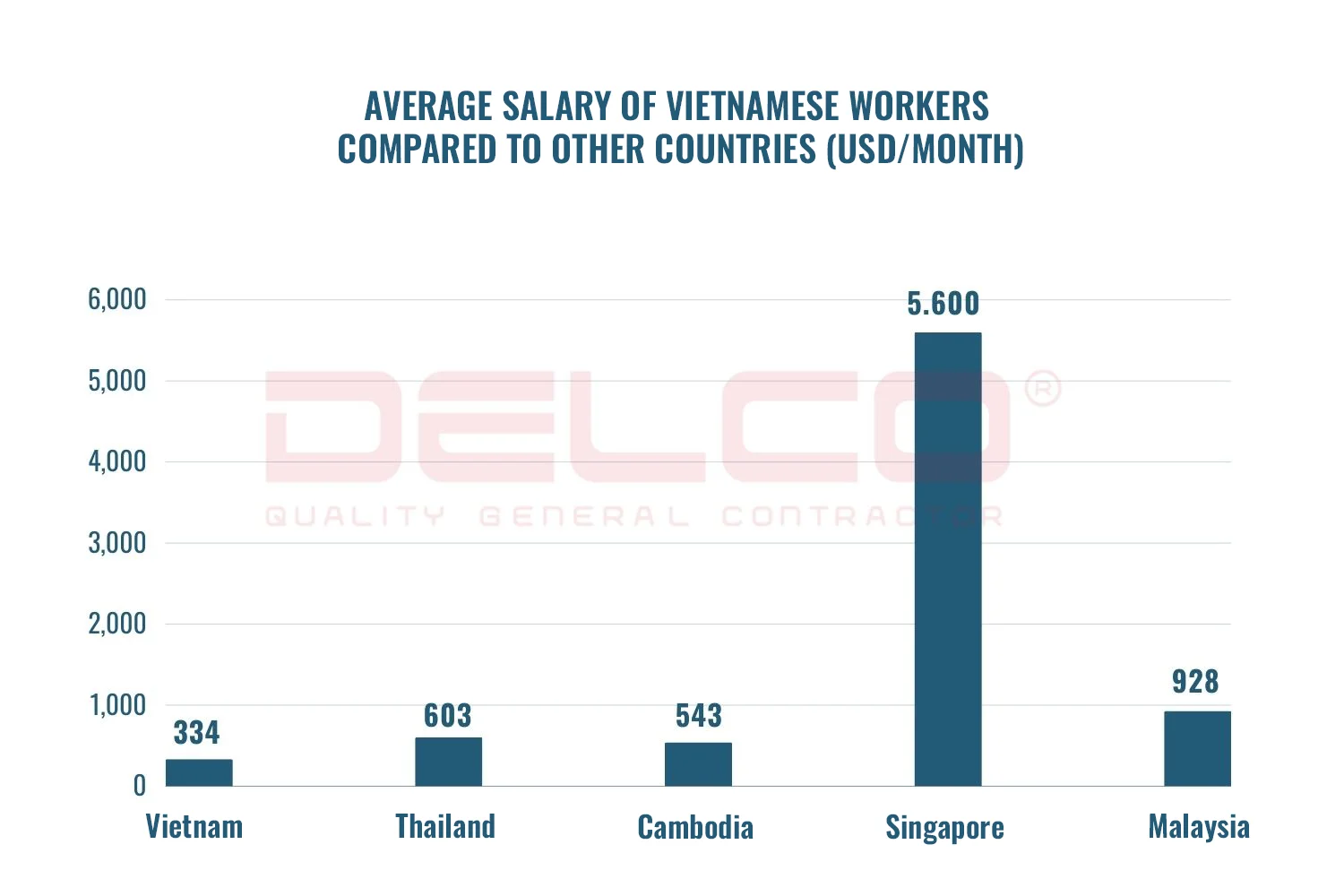

Vietnam is increasingly becoming an attractive investment destination for foreign enterprises in the export processing enterprises (EPE) because of its stable economy and politics recovering well after the Covid-19 pandemic. In particular, Vietnam possesses abundant labor resources and cheap labor costs, which are important factors to strongly attract FDI investors. According to a report by the General Statistics Office, Vietnam is one of the top countries having the most competitive labor costs today with an average salary of 334 USD/month. This salary is much lower than that of other countries in the region such as Thailand which is 603 USD/month, Malaysia which is 982 USD/month, Cambodia which is 543 USD/month, Singapore which is 5,600 USD/month…

In addition, Vietnam also participates in signing free trade agreements such as FTA and ATIGA to help businesses enjoy tax exemptions and reductions for exporting to EU and ASEAN countries. In particular, export processing enterprises investing in Vietnam also enjoy preferential policies from the government such as:

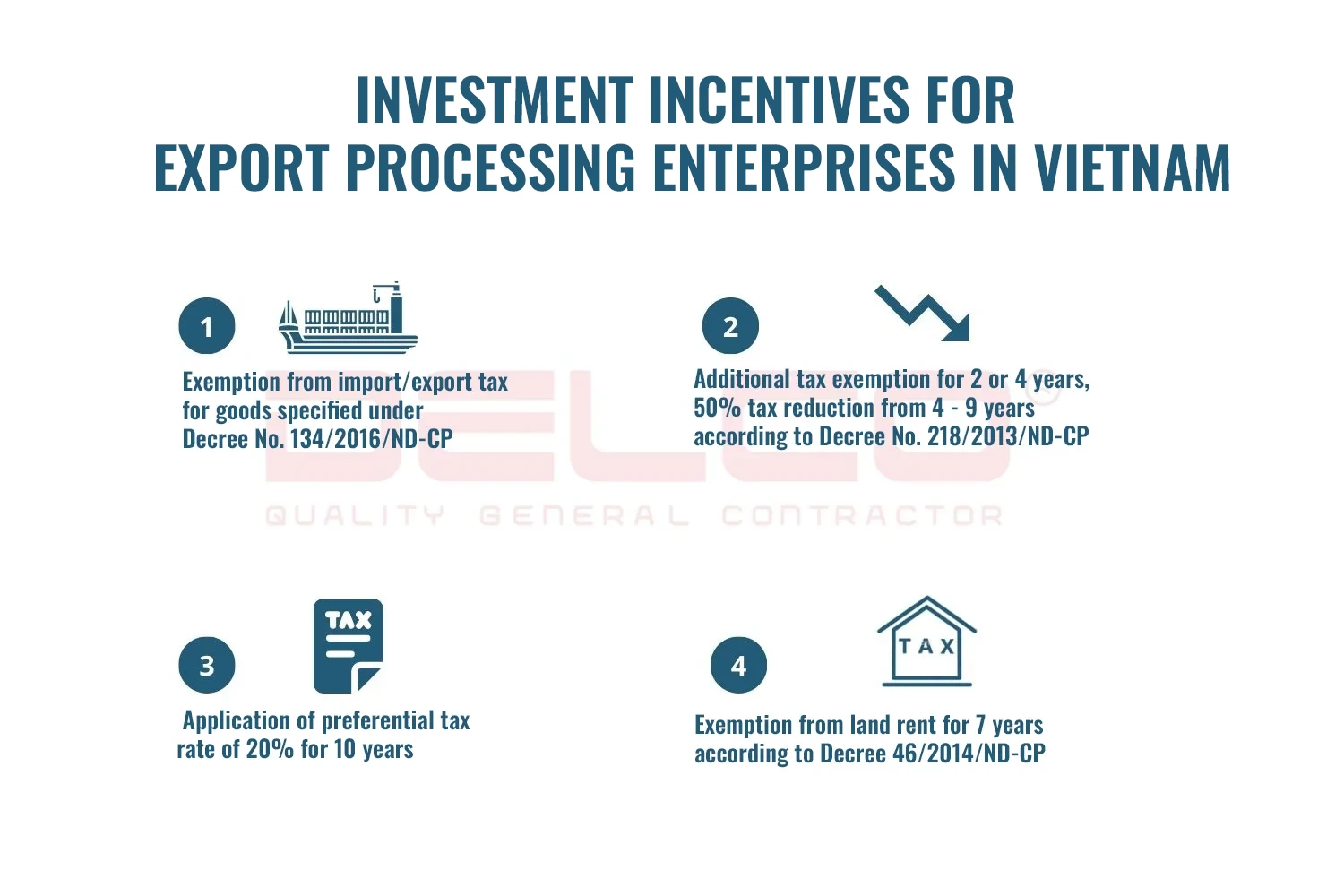

- Exemption from import/export tax: export processing enterprises are exempt from import tax for goods that create fixed assets and are exempt from export tax for goods exported from export processing zones to foreign countries according to Decree No. 134/ 2016/ND-CP.

- Corporate income tax incentives: enterprises implementing new investment projects in areas with difficult socio-economic conditions are entitled to a preferential tax rate of 20% for a period of 10 years. Businesses are also entitled to additional tax exemption for 2 or 4 years, 50% tax reduction from 4 to 9 years according to Decree No. 218/2013/ND-CP.

- Land use incentives: Export processing enterprises are exempt from land rent for up to 7 years according to Decree 46/2014/ND-CP.

In addition, the impact of the US-China trade war caused many export products from China to have taxes increased, foreign businesses in China gradually withdrew from this market and a number of large businesses have shifted a part of the production line to Vietnam.

Above all, the world’s consumption trends are changing towards focusing on green and sustainable products. Meanwhile, Vietnam is a country with the potential to develop green industry as the Government has introduced many policies to attract and build ecological and environmentally friendly export processing zones. This is also an attractive factor for many FDI enterprises to invest in the export processing sector in Vietnam.

Development trends of the export processing sector in Vietnam

In Vietnam’s industrial development strategy to 2025, with a vision to 2035, Vietnam has set a development orientation for the industry in general and the export processing sector in particular towards green and sustainable development, focusing on high-tech industries and biotechnology export processing zones. Vietnam is gradually shifting its production structure to sectors and products with high added value and large export value; primarily quantity-based to quality-based.

Vietnam encourages businesses to apply modern and environmentally friendly technology in production. For newly established export processing zones, it is required to have a wastewater treatment factory, focusing on attracting selective investment in the direction of prioritizing projects with high technology, using little labor and creating export products that are highly competitive in the market.

Projects of planning, expanding export processing zones and improving transport infrastructure are focused on. Vietnam promotes the development of export processing zones in provinces with favorable infrastructure locations, continues to build e-government and digital government to reduce time and costs for businesses when investing in Vietnam.

Challenges that export processing enterprises in Vietnam are facing

Despite the existing advantages, the export processing enterprises in Vietnam still face many challenges such as competing in export products with countries in the region and the world that have famous brands and more advanced production lines. Vietnam’s response to the demand for greening its supply chain remains relatively slow, while environmental concerns and emissions reduction requirements are becoming more and more urgent. The trend of consuming green products and sustainable products is increasing day by day.

In addition, industrial sectors and products in Vietnam have low added value. The internal strength of the industry is weak and depends on foreign invested areas. Furthermore, the scientific and technological level of many businesses is still limited. Priority development industries have not achieved their set goals.

To overcome these difficulties, Vietnam has introduced many sustainable development policies such as Resolution 50-NQ/TW, Decision 667/QD-TTg to improve institutions, the quality and efficiency of foreign investment cooperation. As a result, it has significantly attracted FDI investors, increasing the export value of Vietnam’s export processing industry.

See more: Vietnam Investment Law: Investors need to know – Updated 2023

See more: FDI attraction situation in Vietnam 2023: sustained growth momentum, attracting global investors