Many experts believe that Vietnam’s economy will face more difficulties in 2023. Meanwhile, some other organizations argue that Vietnam’s economy is a bright spot in the region and will grow dramatically.

Challenge or opportunity?

Unpredictable unknowns

According to the General Statistics Office, the Index of Industrial Production (IIP) in January 2023 is estimated to decrease by 14.6% compared to the previous month and decrease by 8% over the same period last year. In particular, the index of production of some key industries decreased, such as processing and manufacturing decreased by 9.1%; mining decreased by 4.9%; electricity production and distribution decreased by 3.4%…

Index of Industrial production in January for the period of 2014 – 2023 (%)

According to Ministry of Industry and Trade, the number of exporting orders has shown an downward trend from September, 2022. Up to now, import and export turnover of the whole country has experienced a dramatic decline. Total export and import turnover of goods in January 2023 only reached 46.56 billion USD, an decrease of 17.3% compared to the previous month and an decrease of 25% over the same period last year; of which, exports reached 25.08 billion USD, a decrease of 21.3% over the same period.

A sharp decline in export orders since September, 2022

The decline in orders is expected to continue for the next few months due to political conflicts in many regions, unstable gasoline prices, inflation in many countries expected to extend, especially US and Europe – the two main export markets of Vietnam. In addition, reduction in financial support related to Covid – 19 by national governments also makes households tighten their spending. The decline in imports and consumption of goods from key markets will put great pressure on Vietnam’s manufacturing and export enterprises.

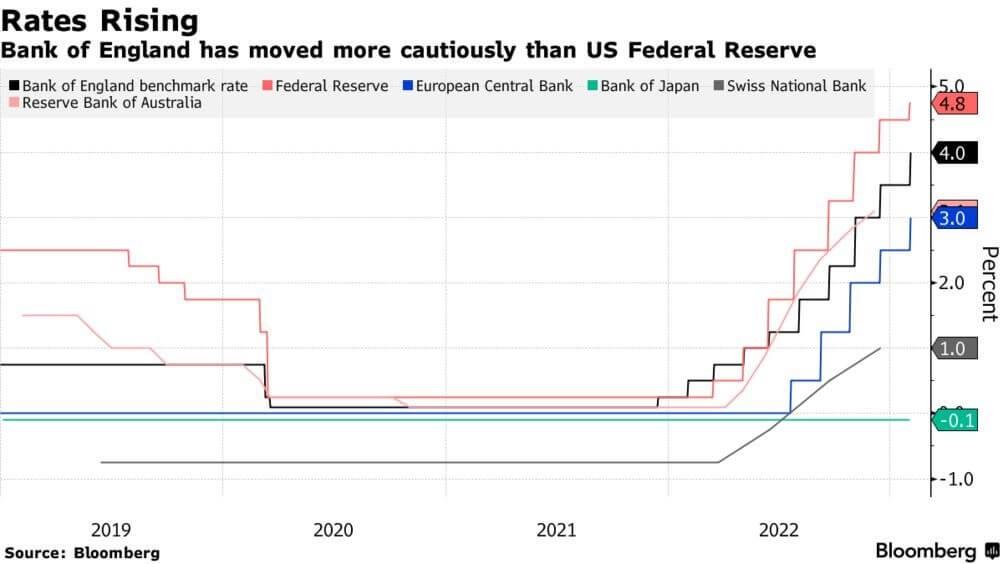

The US Federal Reserve System (Fed) plans to raise interest rates to 5-5.25%, which causes a sharp increase in interest rates in the world, Vietnam State Bank also 2 times increased the operating rate, putting pressure on capital costs, creating delay in production and increasing domestic inflation pressure.

In addition, China lifting the lockdown due to Covid-19 may increase pressure on the price of gasoline and input materials for worldwide production. A great number of Vietnam’s industries including apparel, metallurgy, chemicals, and electronics, are subject to inputs from China. China’s production structure and import and export of goods are similar to Vietnam’s, however, the level of technology is higher and the scale of production is larger, which will create competitive pressure on many Vietnam’s exports.

However, most of the forecasts state that Vietnam’s economy faces many difficulties at the beginning of 2023, but policies will start to improve gradually after inflation control by the end of the year.

Potential bright spots

Vietnam’s economy is assessed to have a number of factors that can motivate growth in 2023. First of all, the economy is highly adaptable. In 2022, coping with the pandemic and motivating production and recovering strongly, Vietnam will continue to adapt to socio-economic fluctuations in 2023.

During the last pandemic, Vietnam maintained stable growth and was among the highest GDP growth groups in the region.

Over the past few years, State Bank has taken measures to stabilize VND exchange rate into USD, stabilize macro balances, and support enterprise to recover and develop. The continued improvement of the investment environment will be the condition for foreign investors to increase investment in Vietnam. Increase in FDI will reduce the upward pressure on the exchange rate and VND inflationary pressure. Political stability, assured social security, and controled inflation are factors that help Vietnam’s economy maintain good growth.

Finally, improvement in policy mechanism and structure of Vietnamese stock market to meet the requirement of medium and long-term loans supply will be the basis for enterprises to promote capital mobilization on the stock market and fulfill the requirement of cheap medium and long-term capital for recovery and growth.

On the morning of January 12nd, Central Institute for Economic Management (CIEM) announced that Vietnam’s economic growth prospects in 2023 were 6.47% or 6.83%. These growth rates are quite high compared to the average world growth forecast of 2.2% given by that report.

Picture of Conference of Vietnam Economic in 2022 and outlook in 2023 organized by CIEM

In Vietnam Economic Growth Report at Quarter IV 2022 and propects in 2023 conducted by Global Economics & Markets Research Department of UOB Bank (Singapore) and published on January 3rd, UOB forecasts that Vietnam’s GDP growth in 2023 is at 6.6%.

During her first visit to Vietnam in early January 2023, Antoinette Sayeh, Deputy Director General of International Monetary Fund (IMF), said that IMF estimates that Vietnam is likely to grow by about 5.8% this year. In the Global Economic Outlook Report released on January 10th, World Bank also forecasts growth of about 6.3% for Vietnam’s economy in 2023. These are all optimistic outlook forecasts compared to the overall economic situation in the region.

Ms. Antoinette Sayeh, Deputy Director General of International Monetary Fund (IMF), assessed during the first meeting in Vietnam on January 10th.

FDI forecast in 2023 – what opportunities are for Vietnam?

Difficult to receive high-quality FDI inflows

According to Mr. Nguyen Dinh Nam, Chairman of IPA Vietnam – an enterprise operating in the field of investment promotion and consultancy, the majority of the $ 12.45 billion of newly registered capital in 2022 (till December 20th, 2022) comes from capital increase, capital contribution, and large-scale production expansion of existing FDI enterprises.

In addition, many major economies are tending to encourage and promote production and FDI flows back to the US, European Union, Japan… Barriers of visa duration are not enough for investors to survey the investment environment in localities. The problem of regulation explanation and applications among localities… also makes it difficult to attract FDI in Vietnam.

In addition, the rapid growth of industrial park land tax fee in recent years has also influenced the decision to invest FDI in Vietnam. A CBRE statistic shows that the average industrial land rental fee of tier 1 market in the North stood at $120/m2/term by the end of 2022, an increase of 11% compared to 2021. Some industrial zones in Bac Ninh and Hung Yen significantly increased rental fee, with the main increase of about 6-7% per year.

Data from China’s Ministry of Commerce (MOC) shows that FDI investment in China’s high-tech manufacturing increased by nearly 60% in 2022 compared to the same period of the previous year. High-tech FDI tends to increase in China, leaving a gap in FDI attraction for the labor-intensive sector and cheaper and less technological costs for the rest of the countries. At this time, Vietnam can attract FDI to produce goods exported to the Chinese market, contributing to reducing the level of difference in the trade balance. In particular, when Regional Comprehensive Economic Partnership (RCEP) came into force, this opportunity became even more apparent.

Read more: Top reasons why to build a factory in Phu Tho

Positive signals in FDI investment in January, 2023

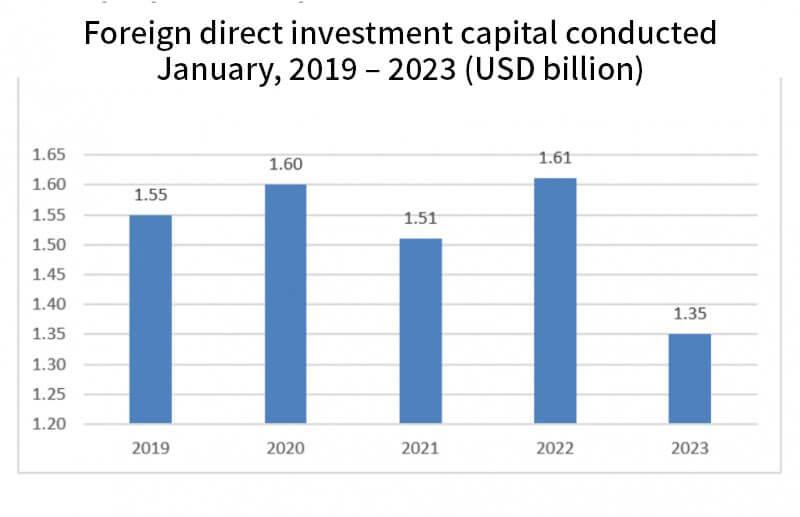

According to General Statistics Office, the total FDI registered in Vietnam in January, 2023 decreased by nearly 20% over the same period in 2022. However, there were 153 newly granted projects, with a total registered capital of 1.2 billion USD, an increase of 48.5% in the number of projects and 3.1 times in registered capital over the same period last year. The results of attracting new FDI projects in January 2023 are considered a positive signal, opening up opportunities for Vietnam in 2023. Many forecasts suggest that Vietnam could attract $36-38 billion this year.

According to General Statistics Office, 28 countries and territories had newly licensed investment projects in Vietnam in January, of which Singapore was the largest investor with 767.6 million USD, accounting for 63.7% of the total newly registered capital. China ranked second with 198.2 million USD, accounting for 16.4%.

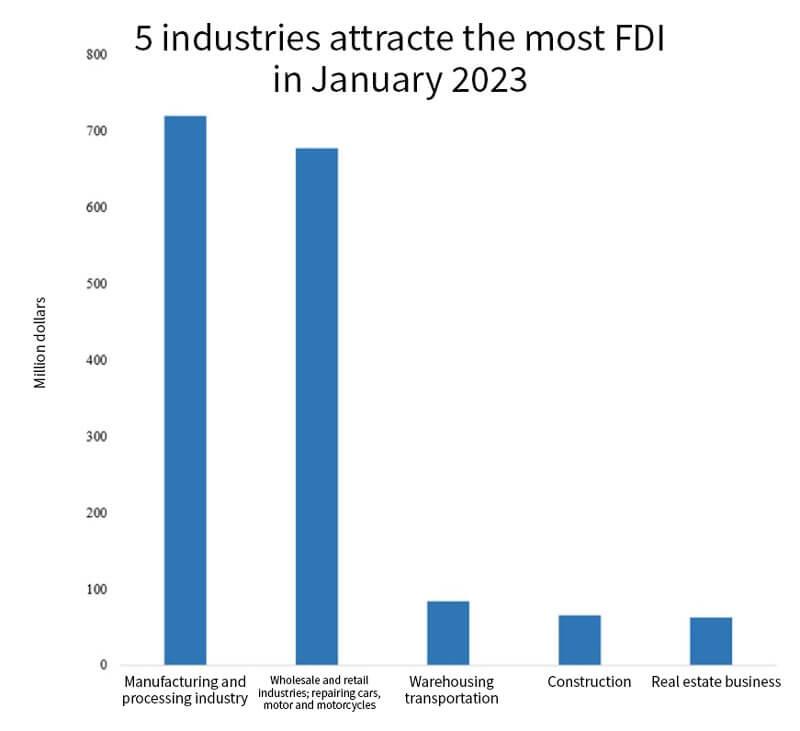

According to data from Ministry of Planning and Investment, foreign investors have invested 17 out of a total of 21 national economic sectors. In particular, the processing and manufacturing industry took the lead with a total investment of 718.72 million USD, accounting for 42.64% of the total registered investment capital.

Wholesale and retail industries; repairing cars, motor and motorcycles ranked the second place with a total investment of 676.29 million USD, accounting for more than 40% of the total registered investment capital. This was followed by transportation, warehouse and construction industries with a total registered capital of more than 82.92 million USD and 63.7 million USD, respectively. The rest are other industries.

Source of information: vneconomy.vn; cafeF; Investement Newspaper; Saigon Economic Newspaper

Read more: 4 mandatory regulations applied when building factories in Vietnam

— The Article are conducted by DELCO® Construction’s content team. The copyright of the article at delco-construction.com website belongs to DELCO® Construction. Please do not copy or edit any content without written consent from DELCO. —