As the world’s second-largest exporter of footwear and the third-largest exporter of textiles, Vietnam has become an investment destination for many FDI enterprises in the textile and leather footwear industries thanks to various tax exemptions and

Current situation of Vietnam’s textile, garment and footwear industry

The textile, garment and footwear industry is one of the industries that play an important role in the Vietnamese economy. These industries have contributed to creating jobs and transferring the economic and labour structure from agriculture into industry. These are also Vietnam’s key export industries, accounting for 12.52% of the country’s total GDP, with export revenue reaching 71 billion USD in 2022. In particular, the textile industry reaches 44 billion USD and the leather footwear industry reaches 27 billion USD. These two industries attracted more than 4 million workers.

n early 2023, the export turnover of the textile industry tended to decrease and the Vietnam Textile Association estimated it to reach 40.3 billion USD, a 9% decrease compared to 2022. Many workers have been laid off due to the impact of the Covid-19 pandemic, demand in export markets decreased. Furthermore, modern production lines helped companies require fewer workers. Nevertheless, by the end of 2023, the GDP of Vietnam’s textile, garment, and footwear industry has tended to increase again.

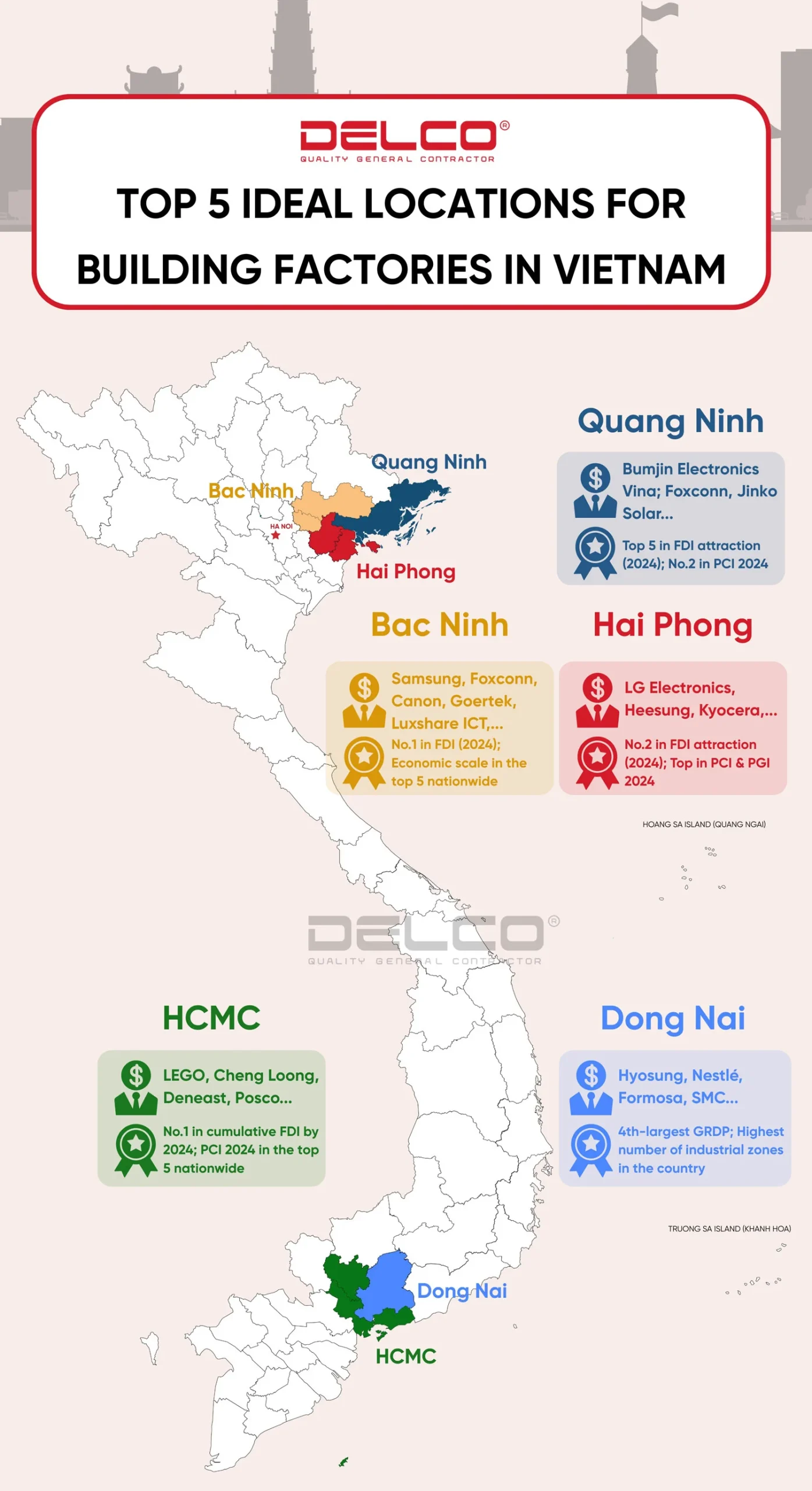

Currently, Vietnam has more than 400 industrial parks, including about 3,000 factories and manufacturers in the textile, garment, and footwear industries. Several big brands such as Adidas, Nike, HM, Mango, etc. also set up production chains in Vietnam.

See more: Vietnam’s 2023 GDP and 2024 Growth Forecast

Why does Vietnam attract FDI enterprises in the textile industry and leather footwear industry

Many FDI enterprises choose to invest in Vietnam not only because it is a country with a convenient transportation location, abundant labor force, cheap labor costs but also because it is a country with a strong advantage in textile, garment, and footwear exports. In 2023, Vietnam is the world’s second-largest export country in leather footwear and third-largest export country in textile industry, just behind China and Bangladesh.

In addition to the available advantages, Vietnam also attracts FDI capital in the textile, garment, and footwear industries thanks to trade agreements and preferential tax policies. Vietnamese businesses will be exempted and reduced in export taxes to EU and ASEAN countries according to the CPTPP and EVFTA agreements that Vietnam has signed. Businesses also receive a reduction in import tax and VAT; tax exemptions for products supporting the textile industry such as natural fibers, synthetic fibers, knitting fabrics… according to Decree No. 57/2021/ND-CP.

After the US-China trade war, the US increased tariffs to 10% instead of 2-4% on garments imported from China. This situation caused many difficulties for businesses, leading many enterprises to consider moving their manufacturing out of China. Meanwhile, Vietnam is a country which has strength in exporting textiles and leather footwear located next to China, so it has attracted the attention of FDI investors and chosen to set up textile manufacturing factories.

Development trends of Vietnam’s textile, garment and footwear industry

Vietnam promotes the development of the textile, garment and footwear industries in the orientation of specialization and modernization; shifting from manufacturing outsourcing to more demanding forms of supply chain management, design and branding building. Enhancing the quality of human resources and training in engineering, technology, management… to meet the needs of the digital industry.

Embracing the global trend of sustainable development, Vietnam has also introduced specific development orientations for each industry.

Textile industry

Vietnam focuses on developing the production of functional fibers, synthetic fibers, and eco-friendly fiber to reduce the import of raw materials from abroad and meet domestic production needs. Woven fabrics, knitted fabrics, and technical textiles are also strongly invested and developed.

Vietnam has built several big industrial parks specializing in textiles, leather footwear and prioritized attracting projects that use advanced technology, synchronous production processes, and ensure compliance with environmental regulations.

In addition, the State also has orientation of attracting FDI investment in the textile industry in provinces which has favorable conditions of infrastructure and abundant labor resources such as Hung Yen, Thai Binh, and Nam Dinh in the North region; Tay Ninh, Long An provinces… in the South region and Nghe An, Quang Ngai, Binh Dinh provinces… in the Central region.

See more: Factors strengthening attraction of factory construction projects in Hung Yen

Garment Industry

The garment industry is focused on developing reputable products in the market, gradually increasing the proportion of high-quality products, shifting production to districts with favourable infrastructure systems and abundant labour resources. Encouraging businesses to focus on technological innovation in production, especially in stages such as designing new patterns, cutting fabric automatically… helps diversify products and increase labor productivity.

Leather footwear industry

The leather and footwear industry is oriented to shift from producing traditional products to mid-range and high-end products, popular and fashionable products. Businesses focus on developing fashion models, researching market demand, and researching the application of new materials for domestic products.

The leather footwear industry will combine with the textile industry to build and develop specialized industrial parks across the country, focusing mainly on areas with modern infrastructure, favourable locations and attracting priorities of modern technology and environmentally friendly projects.

Supporting industry

Supporting industry projects are oriented to focus on development in areas having many textile and footwear enterprises such as Hung Yen, Thai Binh, Quang Ninh… in the Northern region; Tay Ninh, Long An, Binh Phuoc… in the South region and in the Central provinces such as Thanh Hoa, Nghe An, Quang Nam…

See more: Developing Vietnam’s automobile industry: policies to attract FDI and forecast future growth

See more: Foreign investment in Vietnam FQAs – updated 2023