In 2023, Vietnam has more than 38 thousand valid FDI projects investing in the high-tech sector with a total registered capital of more than 453 billion USD, with accumulated realized capital reaching 287 billion USD, accounting for 63.3% of total registered capital. Many large enterprises in the high-tech industry have invested in Vietnam such as Samsung, Apple, Medochemie, etc.

Current situation of the high-tech industry in Vietnam

In recent years, attracting FDI into the high-tech industry has become Vietnam’s strategic priority. In 2023, Vietnam had more than 38 thousand valid FDI projects investing in the high-tech sector with a total registered capital of more than 453 billion USD, with accumulated realized capital reaching 287 billion USD, accounting for 63.3% of total registered capital. Currently, there are 3 high-tech parks in our country: Ho Chi Minh City, Hoa Lac, and Da Nang high-tech park.

Overview of Da Nang High-tech Park

One of the highlights of Vietnam’s high-tech industry is that it has attracted many large technology corporations in the world, namely Samsung, which has located its Southeast Asia’s largest research and development center in Hanoi with an estimated investment capital of 220 million USD. Samsung also announced an increase in sponsorship for Vietnam from 18 billion USD to 20 billion USD and increased capital to 920 million USD for the Samsung Electro-mechanics Vietnam project in Thai Nguyen province.

Apple also shifted iPad manufacturing from China to Vietnam and required its largest partner – Foxconn to establish a MacBook manufacturing chain in Vietnam. Foxconn and GoerTek announced an additional investment of 300 million USD in Bac Giang province, Pegatron invested about 481 million USD to build a factory in Hai Phong and plans to shift its research and development center from China to Vietnam.

Foxconn factory in Bac Giang province

In addition, the medical technology and pharmaceuticals field made significant progress as AstraZeneca invested nearly 7,000 billion VND and transferred production technology to Vietnam. Medochemie has also invested in 5 high-tech pharmaceutical factories, focusing on medicines produced by using high-quality technology transfer for export to Europe.

Furthermore, the fields of biotechnology and renewable energy are also flourishing, attracting many big names in the world such as Amgen, First Solar, Canadian Solar…

See more: Prospects of attracting FDI from European enterprises into Vietnam in 2024

Why does Vietnam attract FDI enterprises to invest in the high-tech industry?

Vietnam is considered the country with the world’s leading growth rate which is predicted to reach 6% in 2024 by The World Bank. With a stable and developed economic situation, Vietnam emerges as an appealing investment destination for many foreign investors, especially in the high-tech industry.

In addition, several factors such as lower labor costs compared to regional countries, easier integration of supply chains, and better access to free trade also attract large corporations in the technology industry to move to Vietnam. Above all, Vietnam also participates in 15 different FTAs and has trade connections with over 50 countries, which helps businesses take advantage of many tariff incentives and expand export/import markets.

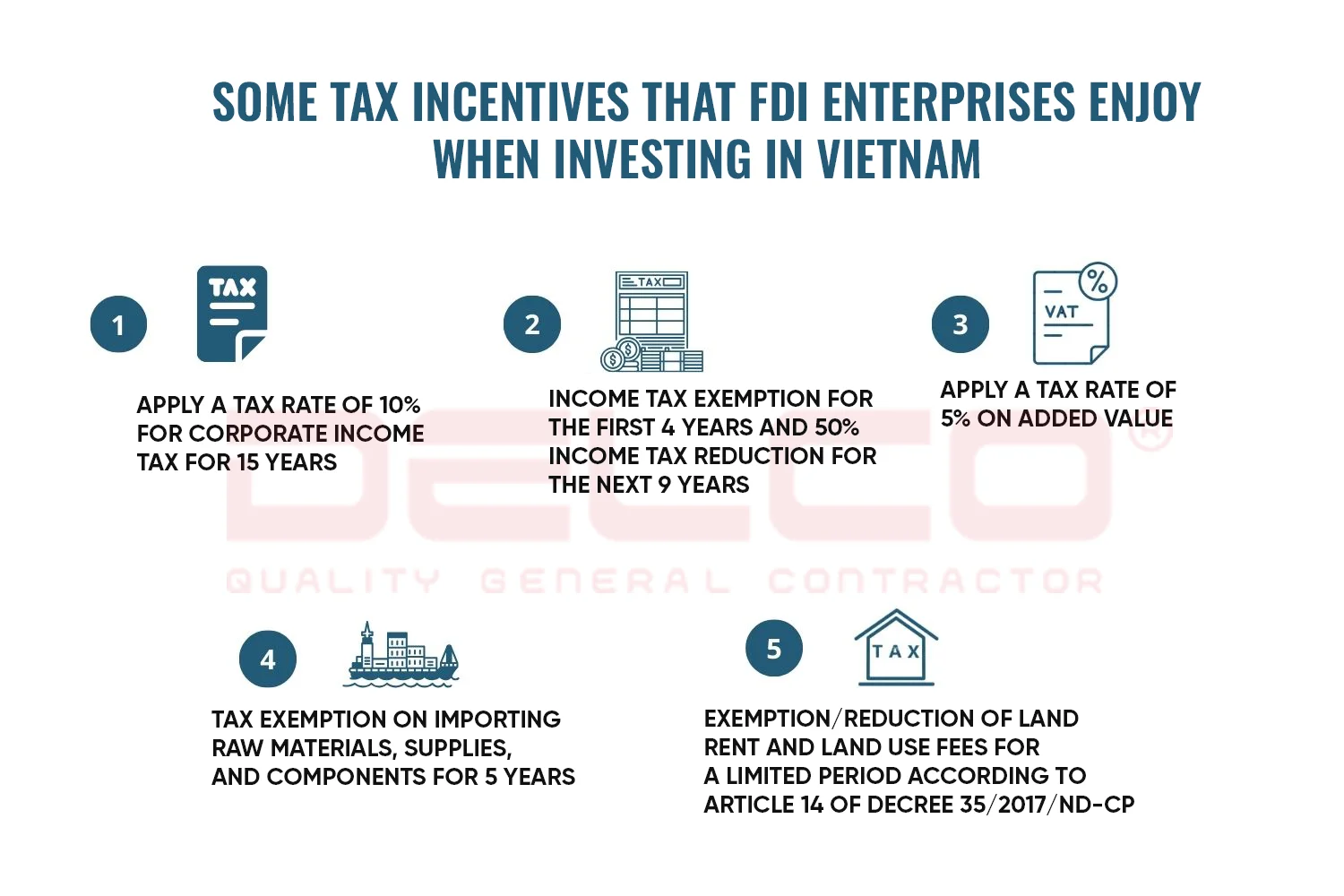

In addition, when FDI enterprises invest in the high-tech industry in Vietnam, they also enjoy preferential tax policies from the Government such as:

- Income tax incentives: businesses are entitled to a 10% tax rate for 15 years according to Article 13 of Law No. 32/2013/QH13, are exempt from income tax for the first 4 years and receive a 50% reduction in income tax in the next 9 following years according to Decree No. 218/2013/ND-CP.

- Value-added tax incentives: businesses are entitled to a 5% tax rate on value added.

- Import tax exemption: businesses are exempt from import tax on raw materials, supplies, and components for 5 years.

- Land rental incentives: businesses are exempted/reduced from land rental and land use fees for a limited period according to Article 14 of Decree 35/2017/ND-CP.

Trends in the development of Vietnam’s high-tech industry

The high-tech industry in Vietnam is gradually restructuring to selectively attract investment, from quantitative to qualitative, shifting focus from exporting low-tech manufacturing products to high-tech products. Vietnam prioritizes projects that apply modern environmentally friendly technology, have high added value, and can connect production chains with human resource training.

Some high-tech industries that have development potential in Vietnam and are of interest to many investors today include electronic technology, information technology, biotechnology, energy technology, etc. Especially in the electronic technology industry, 25 out of 190 Apple partners are setting up factories in Vietnam with the expectation that by 2025 Vietnam will produce 65% of AirPods headphones, 20% of Apple watches and iPads, and 5% of Macbook laptops, etc. The biotechnology industry also attracts the government’s attention and it is expected to grow by 50% by 2030 and contribute up to 7% of the country’s GDP.

In addition, some large Vietnamese technology enterprises have made important breakthroughs, such as FPT Semiconductor, which launched the first line of microchips applied to Internet of Things (IoT) products in the medical field. Viettel has also become a provider of precision mechanical processing products integrated into products for Meggitt’s aerospace industry.

The Vietnamese Government has also set specific goals and strategies to attract high-tech FDI such as committing to promulgate new policies, incentives, and regulations to expand and develop high-tech zones, striving to increase the ratio of foreign registered capital from Europe, America, and Asia will increase to over 70% of total disbursed capital in Vietnam by 2025 and 75% by 2030.

See more: FDI attraction situation in Vietnam in 2023: sustained growth momentum, attracting global investors