Currently, Vietnam’s industrial real estate is a market that attracts attention and interest from domestic and foreign investors because it still has a lot of potential and fiscal space for strong development.

Overview of Vietnam’s Industrial Real Estate Market in 2023

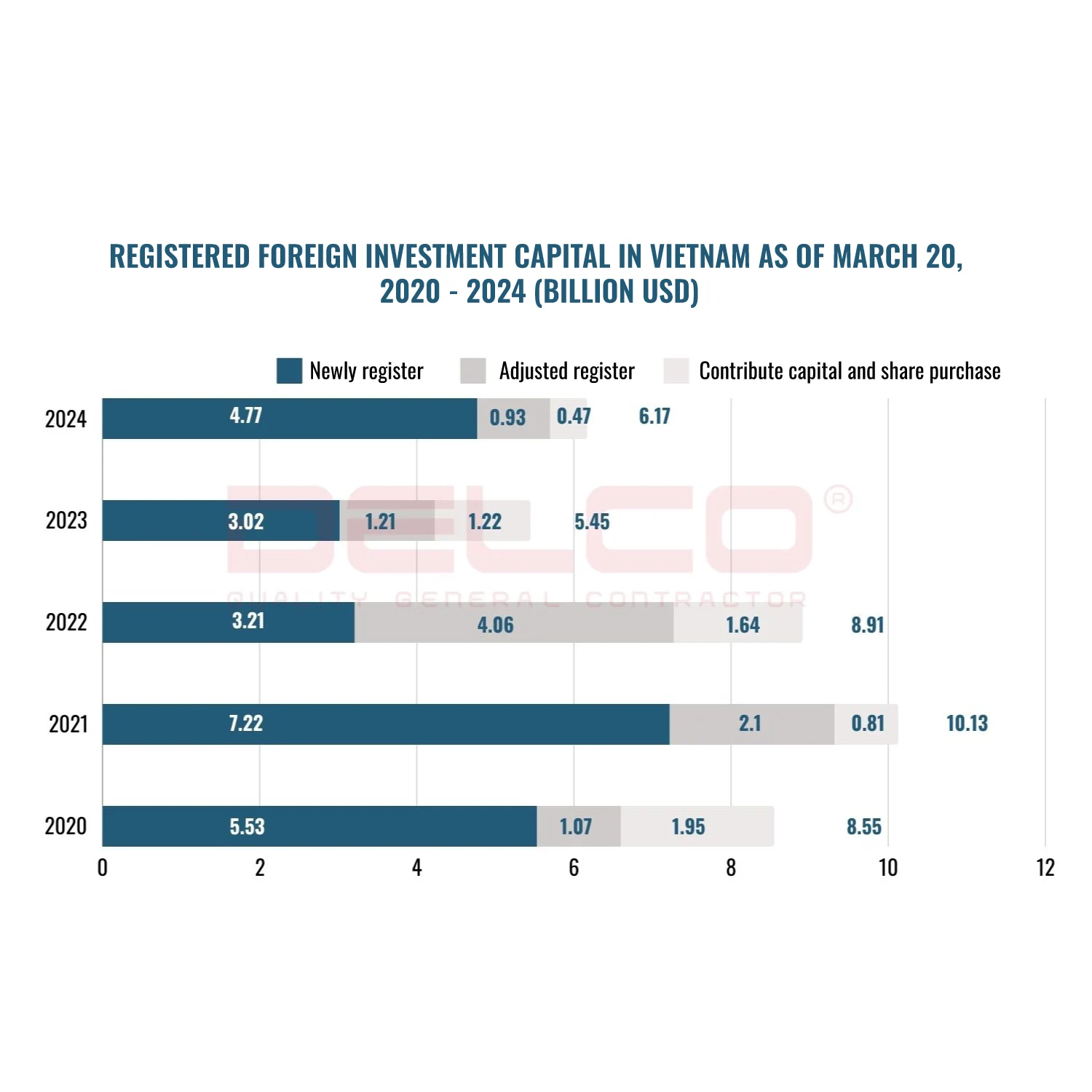

Vietnam’s industrial real estate is currently still on track to attract direct investment capital from FDI enterprises because there is still a lot of fiscal space and potential for further development.

Industrial land area and occupancy rate

The industrial real estate market in 2023 is having obvious changes, the occupancy rate of industrial parks, in general, tends to increase slightly compared to the previous years.

Below is the chart of area and occupancy rate in the most prominent industrial real estate market with the latest updates as of the third quarter of 2023:

In the Northern, occupancy rate of the industrial park in the Northern region decreased to 80.2%, due to an increase in industrial land supply from new industrial parks in Bac Ninh and Hung Yen.

The absorption rate of industrial land in Tier 1 markets reached 251 hectares in the quarter and more than 700 hectares since the beginning of the year, with industrial land rental prices in Tier 1 markets increasing by 2% quarter-on-quarter and 12% year-on-year, reaching 131 USD/m2/remaining term.

In the South, occupancy rate of the industrial park reached 81.9%, and the absorption rate reached more than 190 hectares in the quarter and was nearly equal to the absorption rate of the whole previous year. Industrial land rental prices in Tier 1 markets continue to increase slightly and there is an increase in transactions from Chinese and Japanese businesses.

The average industrial land rental price in Tier 1 markets is currently 189 USD/m2/remaining term, up 1% over the previous quarter and up 13% over the same period last year.

Outstanding FDI projects

In the North, in the first half of this year, the North attracted the largest investment capital of 3.4 billion USD, equivalent to 63% of newly registered FDI projects in the manufacturing sector. There are a number of prominent corporations operating in the North including Samsung, LG Electronics, Pegatron, Foxconn, Goertek, Canon, Hyundai, Honda, Vinfast…

The largest manufacturing investment projects in the Northern Key Economic Region in the first 6 months of 2023

In the South, it ranked second with a total investment capital of 1.4 billion USD, equivalent to 27% of the number of projects. The North still holds the first position with 238 new projects, while the South has 122 projects and the Central has 19 projects.

Prominent projects in the South include Shandong Haohua Tire’s $500 million project in Binh Phuoc, Suntory Pepsico Vietnam’s $185 million project in Long An… and a prominent investment group including LEGO, Suntory PepsiCo, Intel, Unilever, Coca-Cola…

The largest manufacturing investment projects in the Southern Key Economic Region in the first 6 months of 2023

Factors affecting the industrial real estate market in Vietnam in 2023

The real estate market is expected to recover strongly from the end of the third quarter of 2023 thanks to the Government resolving policy, legal and capital issues. Below are the main factors affecting Vietnam’s industrial real estate market:

- The government increases public investment, focuses on important infrastructure development, creates favorable conditions for the real estate industry: This will promote economic development, create demand for housing and real estate.

- Many legal documents have been completed, positively impacting the real estate market: These legal documents will help solve outstanding problems in the real estate market, create a transparent and healthy investment environment.

- Credit in real estate increases, due to reduced deposit interest rates: This will help people and businesses have more capital to buy houses and invest in real estate.

- Infrastructure: The transportation infrastructure system is gradually improving, creating conditions for logistics and the movement of materials and goods between major provinces and cities in Vietnam.

- Policy reform: Major provinces and cities in Vietnam are promoting investment promotion, developing policies to reform administrative procedures, and support investors.

See more: Map of Vietnam’s key industrial zones

Forecasting Vietnam’s industrial real estate market in the future

According to a joint report of the Vietnam Institute of Real Estate Research (VIRES) and Vietnam Real Estate Electronic Magazine (Reatimes), between 2023 and 2030, a forecast of strong growth of Vietnam’s industrial real estate in particular and Vietnam’s real estate market in general in the period 2023-2030 thanks to advances in legal, economic, infrastructure and technology. Currently, the market is at the bottom of the cycle and is expected to gradually inch up until the end of 2023, then enter a V-shaped recovery period from the second mid- quarter of 2024.

The real estate market is forecasted to gradually recover more clearly after the second quarter of 2024

Northern industrial real estate trends

According to experts, the industrial real estate market in 2023 is having an increasing trend in the Northern provinces. This area is attracting the attention of many major investors. The Northern industrial park real estate market is growing strongly because of many advantages in infrastructure, abundant land fund, human resources, geographical location,… in Tier 2 markets, which attracted many large investors.

It is forecasted that in the coming time, the Northern industrial park real estate market will continue to grow. Provinces/cities such as Hanoi, Hai Phong, Quang Ninh, Bac Ninh, Bac Giang,… will be attractive destinations for investors.

Southern industrial real estate trends

According to Ms. Trang Le, senior director of consulting and research at JLL Vietnam, said that the Southern industrial real estate market is still showing positive signs of demand recovery after the net absorption rate of approximately 86,000m2 has been recorded.

According to the development for the period 2021 – 2030 and vision to 2050, the Mekong Delta region is expected to go further in developing infrastructure, creating an attractive foundation for industrial real estate with 6 highways with 1,166 km long.

As for future trends, high technology and sustainable development continuously attract the attention of investors and businesses. Green criteria are increasingly becoming an important factor in the construction of factories and workshops, thereby promoting the development of green industrial real estate in the future.

Information compiled from: Ministry of Construction, Construction Newspaper, Government Newspaper, Business Forum Magazine, Tuoi Tre Newspaper.

See more: Vietnam’s economic situation in 2023 and prospects for 2024