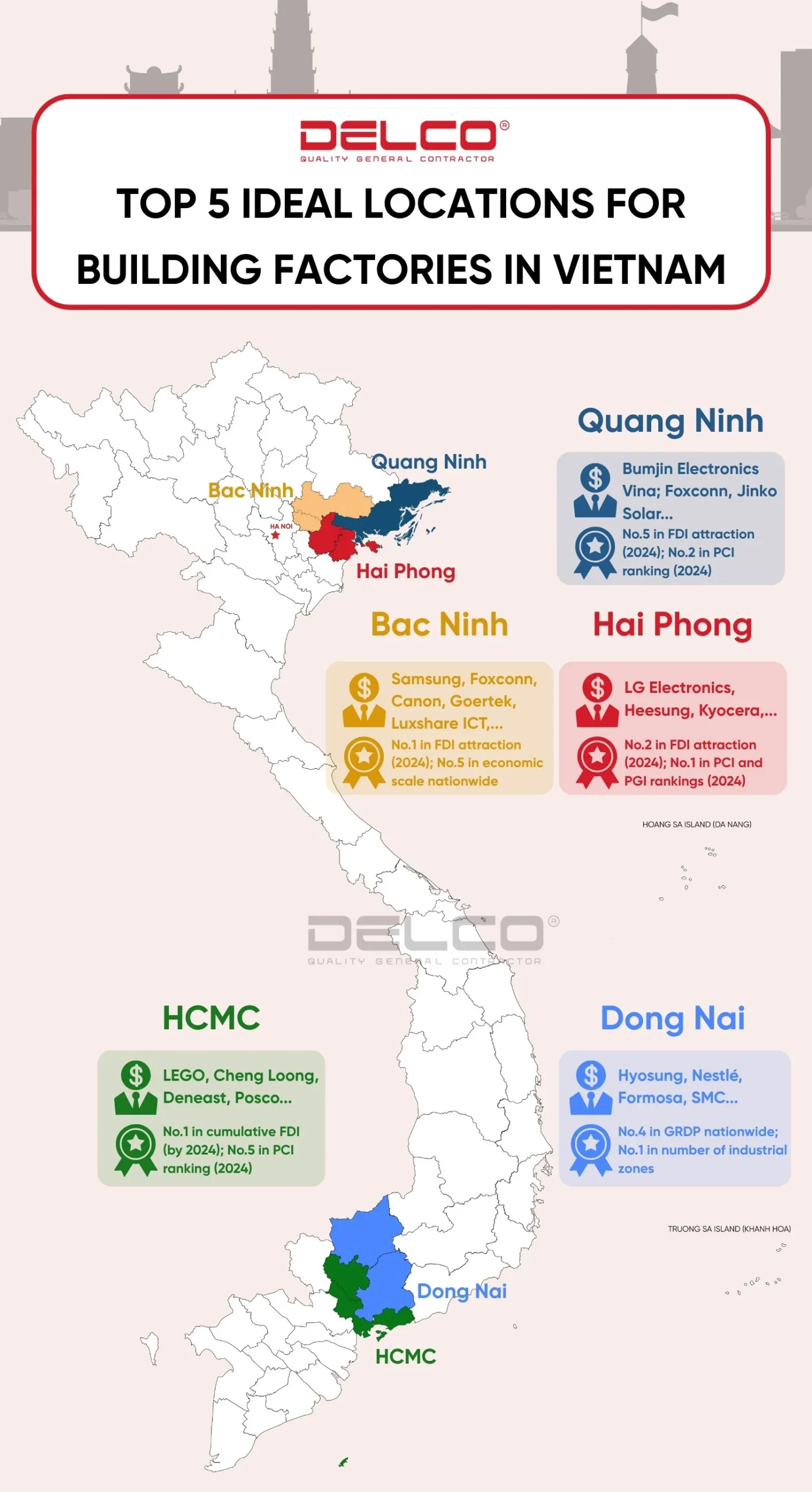

Amid the ongoing shift in global supply chains, Vietnam has emerged as a strategic destination thanks to its competitive costs, abundant labor force, and stable investment environment. This article highlights five provinces and cities that stand out for their infrastructure, available industrial land, and favorable FDI policies, making them attractive choices for investors looking to build factories in Vietnam.

Hai Phong (merger of Hai Phong and Hai Duong): The logistics and industrial hub of Northern Vietnam

As the largest port city in Northern Vietnam, Hai Phong possesses all the necessary elements to become a key center for industry, logistics, and exports. Lach Huyen Port is currently one of the most modern deep-water ports in Vietnam. Alongside the Hanoi–Hai Phong Expressway and Cat Bi International Airport, the city boasts an efficient multimodal transportation network.

Hai Phong is currently home to over 1,000 active FDI projects, with a total registered capital of more than USD 34.6 billion. In 2024 alone, the city attracted USD 4.94 billion in FDI, ranking second nationwide, with 77% of projects in high-tech, electronics, automotive parts, and machinery. Major industrial parks such as VSIP, DEEP C, Trang Due, and Nam Dinh Vu have become preferred destinations for top global corporations like LG, Heesung, and Kyocera. South Korea is the largest investor, with 111 FDI projects. In 2024, Hai Phong topped the country’s PCI (Provincial Competitiveness Index) with 74.84 points and also led in the Provincial Green Index (PGI), demonstrating a transparent and efficient investment environment with a strong commitment to sustainable development.

Hai Phong ranked first nationwide in both the PCI and PGI, with high scores across all sub-indices.

Meanwhile, Hai Duong—recently merged with Hai Phong—also plays a crucial role in Northern Vietnam’s industrial landscape. Strategically located between Hanoi and Hai Phong, the province serves as a key satellite for the capital, directly connected to major seaports, airports, and consumer markets. In the first four months of 2025 alone, Hai Duong attracted USD 157.7 million in new FDI, highlighting its stable appeal, particularly in processing, manufacturing, and supporting industries.

Hai Duong currently has 18 operational industrial parks. Under its master plan to 2050, the province aims to develop a total of 32 industrial parks covering approximately 5,661 hectares, creating a large land reserve ready to welcome new investment projects. The merger of Hai Phong and Hai Duong not only expands the industrial space but also establishes a closed supply chain—from production to logistics and export—making the region an ideal destination for FDI investors building factories in Vietnam.

The transport infrastructure connecting Hai Duong and Hai Phong is continually being upgraded, shortening travel time between industrial parks and seaports, and significantly enhancing logistics efficiency for investors. (Photo: Quang Thanh Bridge)

See more: Measures to reduce logistics cost for FDI investors in Vietnam

Bac Ninh (merger of Bac Ninh and Bac Giang): Vietnam’s electronics manufacturing hub

Bac Ninh and Bac Giang are two provinces with strong industrial development potential, strategically located 30–50 kilometers from Hanoi, near Noi Bai International Airport, and well connected to major seaports in the North. The recent merger of Bac Ninh and Bac Giang has created a tightly integrated industrial zone, enhancing the region’s appeal to large-scale and high-tech FDI projects.

Bac Ninh currently has 21 industrial parks planned, covering over 8,200 hectares. Of these, 15 have been officially established and 12 are operational with relatively complete technical infrastructure. The average occupancy rate of industrial land is around 65%, indicating significant room for further FDI inflows. In 2024, Bac Ninh led the country in FDI attraction with nearly USD 5.12 billion. In the first half of 2025 alone, the province attracted nearly USD 2.8 billion in FDI. This success is partly due to its flexible investment promotion policies, with a strong focus on on-site promotion—helping investors better understand the local environment. Today, Bac Ninh stands as Vietnam’s leading electronics manufacturing hub, hosting major global corporations such as Samsung, Foxconn, Canon, Amkor, and Goertek.

Samsung employees working at Yen Phong Industrial Park, Bac Ninh

Meanwhile, Bac Giang has emerged as a rising star in FDI attraction in recent years. The province has received approval to establish 12 industrial parks, covering a planned area of approximately 2,823 hectares, and is planning to expand to a total of 29 industrial parks with around 7,000 hectares by 2030. Bac Giang has attracted 488 investment projects to date, including 373 FDI projects, with major names in electronics and high-tech industries such as Foxconn, Luxshare ICT, Hana Micron Vina, JA Solar, and Fulian Technology. Industrial manufacturing is now the main driver of the province’s economic growth.

Numerous transport infrastructure projects have been invested in to enhance connectivity between Bac Ninh and Bac Giang (Photo: Ha Bac 2 Bridge)

Following the merger, the new Bac Ninh province is expected to play a prominent role nationally, ranking fifth in economic scale. With ample room for further development, the province is planning to implement major infrastructure projects, including Gia Binh Airport, new expressways, and large-scale, modern industrial zones. Backed by a strong foundation in electronics manufacturing, Bac Ninh is poised to remain a top destination for global technology corporations.

See more: Bac Ninh converges all factors attracting foreign direct investment

Quang Ninh: Integrated infrastructure and flexible investment policies

Quang Ninh is one of the few provinces in Vietnam that boasts a full range of transportation infrastructure, including Van Don International Airport, Cai Lan Seaport, a railway system, and expressways directly connecting to Hanoi and Hai Phong. The province also supports all three forms of industrial development, with eight industrial parks, two coastal economic zones, and three border-gate economic zones.

In 2024, Quang Ninh attracted approximately USD 2.8 billion in FDI, placing it among the top five provinces nationwide. The province currently hosts 218 FDI projects from 20 countries and territories, with a total registered capital of over USD 16.77 billion. Several major global companies have established factories here, including Bumjin Electronics Vina, Foxconn, and Jinko Solar.

Jinko Solar’s solar panel factory at Song Khoai Industrial Park (Quang Ninh).

Quang Ninh is also actively planning and developing modern industrial zones such as Song Khoai, Dong Mai, Texhong Hai Ha, and the Quang Yen Coastal Economic Zone. These zones not only offer well-developed infrastructure and excellent transport connectivity but also benefit from a streamlined one-stop investment procedure. The province prioritizes attracting high-tech, environmentally friendly manufacturing and processing projects that contribute to socio-economic growth. With a PCI score of 73.2 in 2024—ranking second nationwide—Quang Ninh demonstrates a strong commitment to improving its investment environment in a substantive way.

Ho Chi Minh City (merger of Ho Chi Minh City, Binh Duong, and Ba Ria – Vung Tau): Southern Vietnam’s industrial center

The merger of Ho Chi Minh City, Binh Duong, and Ba Ria – Vung Tau is set to form a mega industrial–service–seaport metropolis with one of the strongest competitive advantages in Vietnam. While Ho Chi Minh City remains the economic, financial, and commercial hub of the South, it faces challenges in terms of industrial land availability and high operating costs. In contrast, Binh Duong and Ba Ria – Vung Tau are neighboring provinces with abundant land, well-developed infrastructure, and clear industrial development strategies.

Binh Duong has long been considered the “industrial capital” of Southern Vietnam, with a cumulative FDI volume of USD 42.39 billion as of 2024—ranking second nationwide after Ho Chi Minh City. The province currently has 30 industrial parks and 8 industrial clusters in operation, with near-full occupancy, yet continues to expand with new parks including eco-industrial zones like VSIP and Cay Truong. Binh Duong aims to become a “smart industrial–urban–service center,” prioritizing large-scale, environmentally friendly, high-quality FDI projects—such as the USD 1.3 billion LEGO factory from Denmark, along with expansions by Cheng Loong, Deneast, Dongil, and others. It is also among the top-rated provinces for proactive, innovative investment promotion, administrative reform, and comprehensive digital transformation.

Meanwhile, Ba Ria – Vung Tau holds a strategic coastal position, serving as the Southeastern region’s gateway to the East Sea, with rich maritime resources and the country’s largest offshore oil and gas reserves. The province boasts a well-integrated industrial–port–logistics ecosystem and is considered one of the most favorable areas for large-scale coastal industrial development.

Cai Mep – Thi Vai deep-water port cluster

This is one of the few ports in the region capable of handling vessels over 214,000 DWT and offers direct routes to the US and Europe. The province has 13 operational industrial zones spanning over 7,226 hectares, with key sectors including petrochemicals, gas-fired power, steel, building materials, and logistics. In 2024, Ba Ria – Vung Tau achieved a PCI score of 71.17, ranking fifth nationwide and leading the Southeast region for the third consecutive year—demonstrating its efforts in administrative reform, investment transparency, and business support.

With its well-rounded advantages in location, international seaports, logistics infrastructure, a favorable investment climate, and abundant industrial land, the Ho Chi Minh City – Binh Duong – Ba Ria Vung Tau region is emerging as a strategic destination for FDI investors to build factories in Vietnam.

Dong Nai (formerly Dong Nai and Binh Phuoc): The industrial and logistics hub of Southeastern Vietnam

Dong Nai is part of Vietnam’s key southern economic region, located just 30 kilometers from Ho Chi Minh City. The province is supported by a growing interregional transport network, including the Bien Hoa – Vung Tau and Ben Luc – Long Thanh expressways, HCMC ring roads 3 and 4, and the expansion of the HCMC – Long Thanh – Dau Giay expressway. These routes provide strong connectivity between industrial parks and international seaports such as Cai Mep – Thi Vai and Phuoc An. Most notably, the ongoing construction of Long Thanh International Airport will further reinforce Dong Nai’s role as a strategic trade gateway in southern Vietnam.

Dong Nai currently has the highest number of industrial parks in the country, with 37 parks established, covering over 13,000 hectares. It has attracted more than 1,700 investment projects with total capital exceeding USD 36 billion. FDI projects are primarily focused on high-tech and manufacturing industries, with the presence of major global corporations such as Hyosung, Nestlé, Formosa, and SMC.

Hyosung (South Korea) is one of the largest investors in Dong Nai.

In 2024, Dong Nai recorded a GRDP of approximately VND 493.819 trillion (current prices), ranking as the fourth-largest provincial economy in Vietnam. This reflects not only its rapidly growing industrial–construction–services base but also a stable investment environment, large-scale production capacity, and a well-developed industrial ecosystem.

Meanwhile, Binh Phuoc, located at the gateway to the Central Highlands, holds a strategic position for regional connectivity between the Southeast, Central Highlands, and Cambodia. Its transport infrastructure is rapidly expanding, with major routes such as National Highways 13 and 14, Provincial Road 741, the North–South expressway, and upcoming projects like the Gia Nghia – Chon Thanh and HCMC – Thu Dau Mot – Chon Thanh expressways.

Binh Phuoc’s transport system continues to be upgraded, enabling better regional integration.

The province has 13 industrial parks planned, totaling nearly 4,700 hectares, with a current occupancy rate of 69%. Several parks, such as Becamex Binh Phuoc and Minh Hung – Sikico, feature large-scale, modern infrastructure with convenient access. According to the provincial master plan, total industrial land will reach 18,105 hectares by 2030. Industrial land rental prices in Binh Phuoc are currently quite competitive, ranging from USD 80 to 100 per square meter—significantly lower than neighboring provinces like Binh Duong and Dong Nai (USD 130–150 per square meter). As of now, Binh Phuoc has attracted 432 FDI projects with a total capital of USD 4.5 billion.

From July 1st, 2025, Dong Nai and Binh Phuoc will officially merge. The combination of Dong Nai’s developed infrastructure and strong manufacturing base with Binh Phuoc’s vast land resources and competitive costs is set to create a new industrial growth hub, offering great potential for long-term FDI investment.

Sources: Quang Ninh Newspaper, Vietnam Financial Times, VnEconomy

See more: Procedures for granting factory construction permits in Vietnam

See more: Changes in Circular 01/2021/TT-BXD on documents appraisal and issuance of construction permits

See more: The wave of attracting investment in the electronics industry in Vietnam